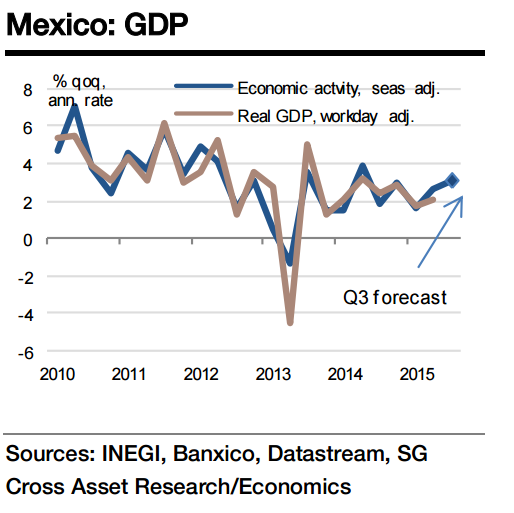

Mexico's economic activity has, in fact, surprised to upside in recent months considering the extent of slowdown in industrial production (particularly in the mining sector). The trade and IP numbers put supply-side growth at close to 2.8% yoy in September. As a result, Q3 supply-side growth is estimated at 2.5% yoy (0.8% qoq or a 3.1% qoq annualised rate compared with 2.5% in Q2 and the current forecast of 2.5% for Q3).

As such, the economy seems to be doing better under the circumstances (dominated by external factors) than most people think (in fact, the Banxico's tone has been dovish on the economy and growth). Therefore, the economy should end up growing faster in 2015 than the current forecast of 2.3%.

Even more surprisingly, led by consumption growth, the demand-side economy seems to be doing much better than the headline growth numbers. The pick-up in real exports has not been as pronounced as previously anticipated and investment growth has probably slowed too; however, given the outlook for the US economy and expectations that commodity prices bottomed in 2015 (leading to improvement in investment growth in the mining sector), the economy is expected to accelerate meaningfully in 2016.

"We continue to forecast above-trend growth in 2016, with both exports and investment growth leading the headline", says Societe Generale.

Consumption growth could slow down marginally from the very impressive growth this year as a return of inflation (above Banxico's target) would slightly outweigh the impact of a falling unemployment rate while wages take time to improve. A sharp slowdown in US growth remains the key downside risk to the economy.

Mexico economy likely to have accelerated in Q3, and looks set to improve further

Thursday, November 19, 2015 11:30 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns