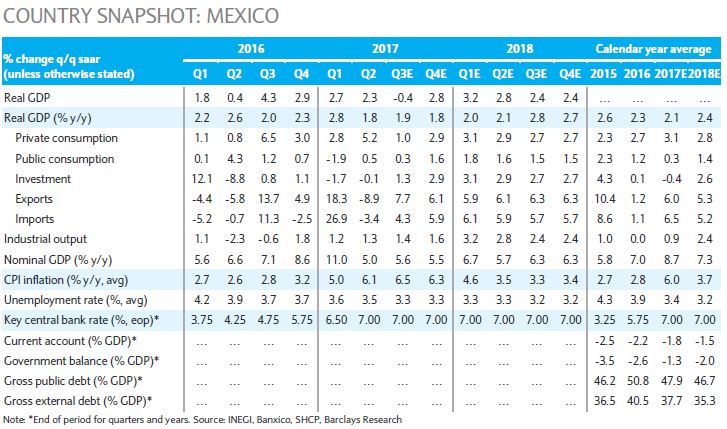

Mexico’s gross domestic product (GDP) is expected to fall by 0.45 basis point in the event of a NAFTA breakup, a possibility that has been discussed in the media recently. Long-term growth would likely decline to 2.0 percent from 2.5 percent currently. Nevertheless, a permanent real depreciation of the peso could also offset this effect, Barclays Research reported.

In particular, Mexican authorities have made clear that it will not concede these proposals and the government is working on a “Plan B,” in case President Trump decides to pull out from the agreement. This plan includes expanding free trade agreements with Argentina, Brazil, and Japan, and to continue the TPP discussions.

In a scenario of a US exit from NAFTA, the likely scenario for Mexico would be the application of Most Favored Nation (MFN) tariffs agreed on by the World Trade Organization (WTO). It highly unlikely that the US would deviate from WTO rules by imposing generalized tariffs on Mexican imports. This action would make the US vulnerable to retaliation from other nations leading to a situation out of the scope of NAFTA.

The textile production sector would be hit the hardest; Mexican exports to the US could potentially fall 4.8 percent in the short run and 9.7 percent in the long run. However, this subsector represents only 0.7 percent of GDP and exports with 62 percent of Mexican value added. Processed food exports could decline 2.6 percent in the short run and 3.8 percent in the long run, which would be a more notable drag on the economy (4.5 percent), the report added.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out