'Amazon is getting into sports collectibles by investing in fractional marketplace Dibbs, which recently launched a feature allowing users to sell stakes in their items with each other.

The terms of Amazon's investment have not been made public, but Dibbs did raise US$16 million in Series A funding in July.

Among Dibbs' investors are Foundry Group and Tusk Venture Partners and athletes Channing Frye, Chris Paul, Kevin Love, DeAndre Hopkins, Kris Bryant, and Skylar Diggins-Smith.

As large sums are involved, some sports collectibles have become prohibitive to potential buyers and minimize the market for owners who wish to monetize their assets.

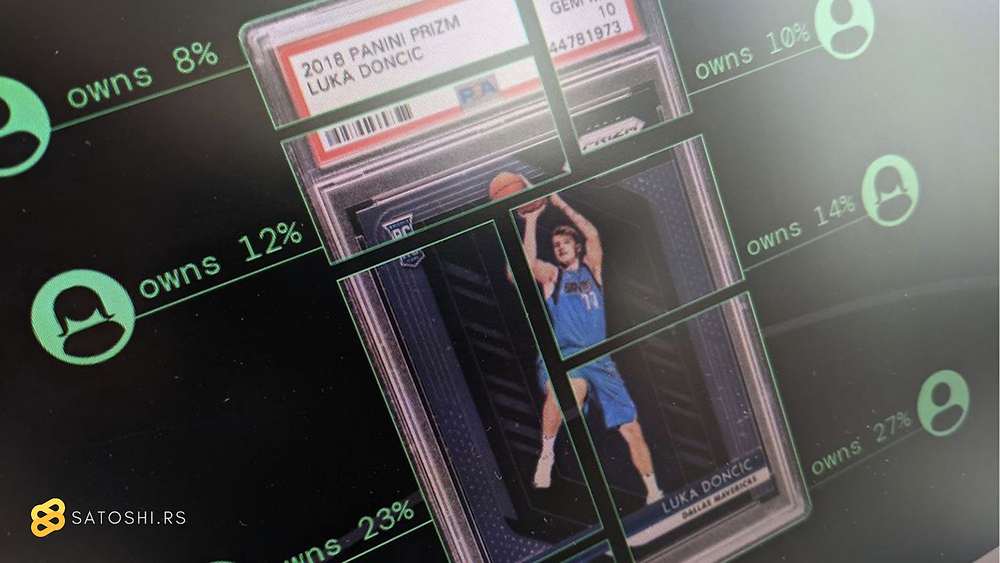

Dibbs was founded in 2020 to offer fractional shares of cards and NFTs, making it more affordable to participate while letting collectors unlock value without ceding total ownership.

Dibbs stores and insures any card listed on the platform and charges a 2.9 percent commission per transaction.

If anyone acquires a 100 percent stake in an asset, they can take possession and ship it to their home.

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  LA28 Confirms Olympic Athletes Exempt from Trump’s Travel Ban

LA28 Confirms Olympic Athletes Exempt from Trump’s Travel Ban  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Why Manchester City offered Erling Haaland the longest contract in Premier League history

Why Manchester City offered Erling Haaland the longest contract in Premier League history  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  U.S. Plans $115 Million Counter-Drone Investment to Secure FIFA World Cup and Major National Events

U.S. Plans $115 Million Counter-Drone Investment to Secure FIFA World Cup and Major National Events  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility