Earlier on Tuesday, the Reserve Bank of Australia (RBA) decided to cut its benchmark interest rate by 25 basis points to a record low level of 1.50 percent. The decision was largely in-line with market expectations. The central bank refrained from providing any hints regarding further rate cuts. With no forward guidance, the monetary policy statement at the end of the week is now looked upon for fresh insight.

“The board judged that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting,” central bank Gov. Glenn Stevens said in an accompanying statement.

The move was well flagged by Governor Stevens, who in previous weeks had suggested loosening policy was necessary in order to boost inflation (which recently hit a 16-year low). Today's cut by the RBA was the second such move this year. The action follows a cut in May as the central bank desperately tries to address record-low inflation and a slowing jobs market.

Official figures last week showed core annual inflation hit 1.5 percent in Q2, well below the RBA’s 2-3 percent target band. Australia created roughly 7,000 jobs a month on average this year, compared with more than 30,000 a month in the second half of 2015. Australia's June economic data was also particularly poor. The trade deficit widened to A$3.195 bln from a revised A$2.418 bln in May (from A$2.218 bln initially). Separately, building approvals unexpectedly fell 2.9 percent in June after a revised 5.4 percent drop in May (initially -5.2%). The median forecast was for an increase of nearly 1 percent.

Much of the latest commentary by the RBA focused on the housing market and diminished concerns around lower interest rates fanning another surge in prices. Risks of stoking a housing bubble, in the RBA’s opinion, are lower than they had been. The RBA noted that growth in lending for housing purposes has slowed a little this year, suggesting that the likelihood of lower interest rates exacerbating risks in the housing market has diminished.

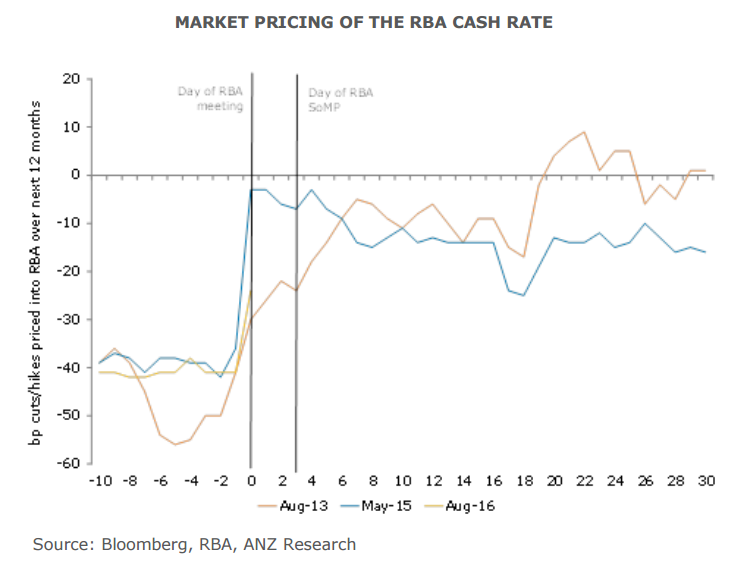

The Australian OIS curve continues to price in further easing, although it is not being particularly aggressive about the amount of expected easing (1-year OIS are only 7.5bps below 1 month OIS).

Capital Economics chief Australian economist Paul Dales tipped further cuts from the RBA if it is eager to meet its 2-3 per cent medium-term inflation target. “If it is going to weaken the Australian dollar to help solve its low inflation problem, the RBA may have to follow today’s interest rate cut with more cuts to 1 percent sometime next year,” he said, adding such moves could drag the local currency down to US65c.

RBA’s decision to cut rates had limited impact on the Aussie. The Australian dollar seemed resilient at the time of writing, testing session highs at 0.7592 after a brief knee-jerk slump to 0.7480 levels. Australian yields tumbled to levels never seen before. Australia’s 10-year rate fell as low as 1.81 percent. The extra yield the bonds pay over similar-maturity Treasuries shrank to 29 basis points, the narrowest since 2001, based on closing levels.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality