CPI inflation eased to 6.3% (YoY) in October and may fall further towards the year-end, given the high base effects from 4Q14. Note that monthly inflation is negative for the second consecutive month. Bank Indonesia (BI) cut interest rates in February, following two consecutive months of negative inflation. This time around, expectations are rising that BI may loosen its policy stance again, particularly following dovish signals from the October policy meeting.

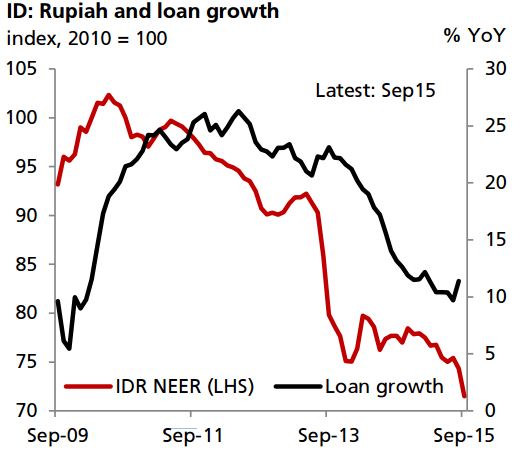

That GDP growth remains lackluster is presumably a strong reason why some in the markets anticipate a rate cut. Yet, if underlying demand in the economy is weak, a rate cut may not boost loan growth by much at this juncture. The effectiveness of a rate cut in boosting GDP growth is questionable if businesses are not willing to make new investments anyway.

Confidence among business owners has taken a toll alongside the weaker rupiah in recent years. Arguably then, sentiment may not improve until we see some stabilization of the rupiah going forward. This is the main reason why BI has been active in the market to prevent excessive weakening of the rupiah. And it also explains why the central bank is no longer tolerant of a weak currency.

Uncertainties in global markets persist. Monetary policy divergences in the G3 economies are likely to keep the broad USD strength intact (see "Monetary policy divergences intact", 2 November 2015). An interest rate cut may send the wrong signals at this juncture. Despite BI's slightly dovish statement in October, a rate cut is not necessarily in the offing.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom