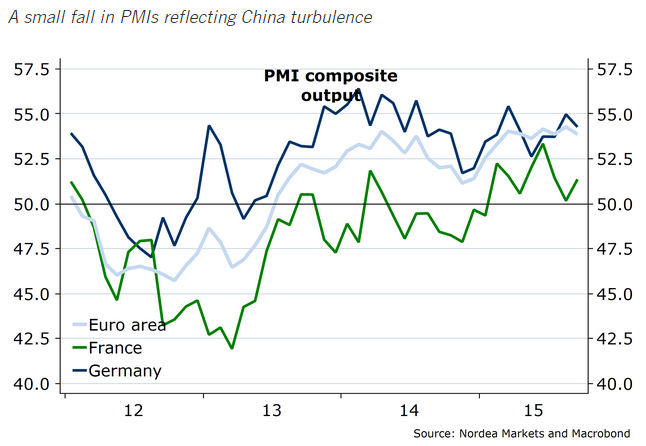

The PMIs fell more than expected in Germany, pulled down particularly by lower manufacturing confidence. Whereas, the levels are still high indicating a growth rate around 0,4 % in the third quarter of 2015, argues Nordea Bank.

Domestic demand appear to keep up the German incoming orders reflecting lower demand from emerging markets and China. This effect could be more than temporary since it is already visible in incoming orders.

The turbulence in China has had a negative effect on Euro area confidence, the effect being most visible in Germany. The manufacturing PMI of Euro zone fell to 52 from 52.3 and the services sector fell to 54 from 54.4, both still indicating solid growth in September, notes Nordea Bank.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off