Turkey’s cabinet decided to propose a State of Emergency (SoE) after a recommendation from the State Security Council yesterday. The state of emergency allows President Erdogan to rule by decree for three months, limit freedom of press and other constitutional liberties, and grants provincial governors extraordinary powers.

Turkey's average sovereign rating is at the risk of slipping to junk for the first time in three years. Moody’s rating agency on Monday this week placed Turkey’s Baa3 credit rating on review for a possible downgrade. Fitch Ratings also noted on Monday that there are ‘political risks’ to Turkey’s credit profile but didn’t take any ratings action. Fitch said its next scheduled sovereign rating review on Turkey is due on August 19th. Ratings agency S&P on Wednesday downgraded Turkey's sovereign credit rating.

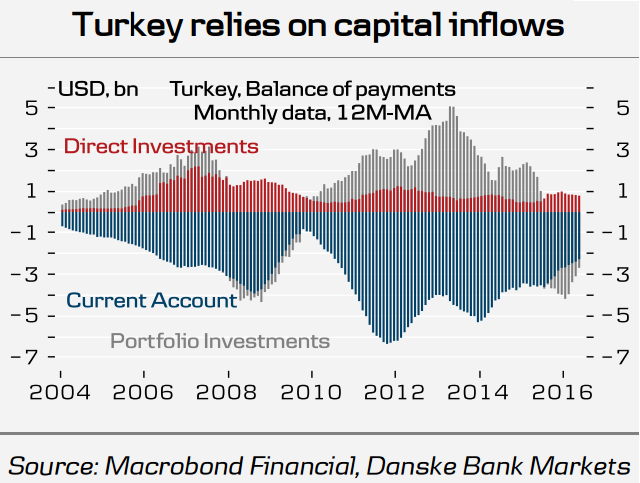

Positioning in Turkey has been reduced compared with early 2013 and its recent increased political predictability could see emerging market investors shift further out of Turkey. Although foreign investment increased 36 percent y/y in 2015 to US$16.5 billion (UNCTAD), figures for this year will be less impressive and far below the high water mark of $22 billion registered in 2007. Turkey still runs a relatively large current account deficit of around 4% of GDP and hence is in need of capital inflows.

The indebtedness of the non-financial corporate sector, which, according to the Institute of International Finance amounted to 56.8 percent of gross domestic product at the end of 2015, is low compared to developed markets, but it has risen substantially over the years. The rate at which this debt has expanded is second only to China and Turkey's companies are struggling to generate sufficient foreign currency to pay their dues.

S&P estimated Turkey must roll over just under half of its total external debt -- which it put at around $170 billion -- over the next 12 months. Turkey’s political landscape has fragmented further following the failed coup attempt, which will undermine the country’s investment environment, growth and capital inflows. Hence, the risk to Turkey’s ability to roll over its external debt has increased.

"In light of the changed political landscape in Turkey, we have lifted our USD/TRY forecasts to 3.12 in 1M (from 2.95), 3.20 in 3M (2.98), 3.25 in 6M (3.03) and 3.35 in 12M (3.05)," said Danske Bank in a report.

The Turkish lira has weakened around 6% since the attempted coup last Friday. Lingering political uncertainty is likely to weigh on capital inflows into Turkey and thereby on the TRY. USD/TRY was trading 3.0745 at 1045 GMT.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal