LG Display is halting activities in its production plant in Paju, Gyeonggi Province. This means the company will stop manufacturing LCD TV panels as the factory is shutting down this month.

According to The Korea Times, LG Display made the decision to close its LCD TV plant in South Korea this year because it is losing its competitiveness in the flat-screen display market. Business insiders said that this was due to the growing number of Chinese rivals that are making the same product but are sold at much cheaper prices.

As a result of the Paju plant’s closure, LG Display is also expected to put an end to its production of LCD TV panels at its P7 plant. This facility was completed in 2005 and started producing the panels the following year. The products that were manufactured here made the company, the leading LCD producer.

However, Chinese rivals cropped up and flooded the market with cheaper LCD panel products. These firms received large amounts of subsidies from their government and this was why they were able to offer LCDs at much lower prices.

But while the Chinese LCD panel producers prosper, LG Display started to lose sales, and its LCD business has been dropping since 2017. It continued in the next years, and the demand declined. This has led to the decision to shut down its Paju plant.

"The P7 is going to be closed six months to a year ahead of what we have said," LG Display’s chief financial officer, Kim Sung Hyun, said during the recent investors’ earnings conference call for Q3. "We cannot clearly tell the specific time as we are communicating with our customers and employees."

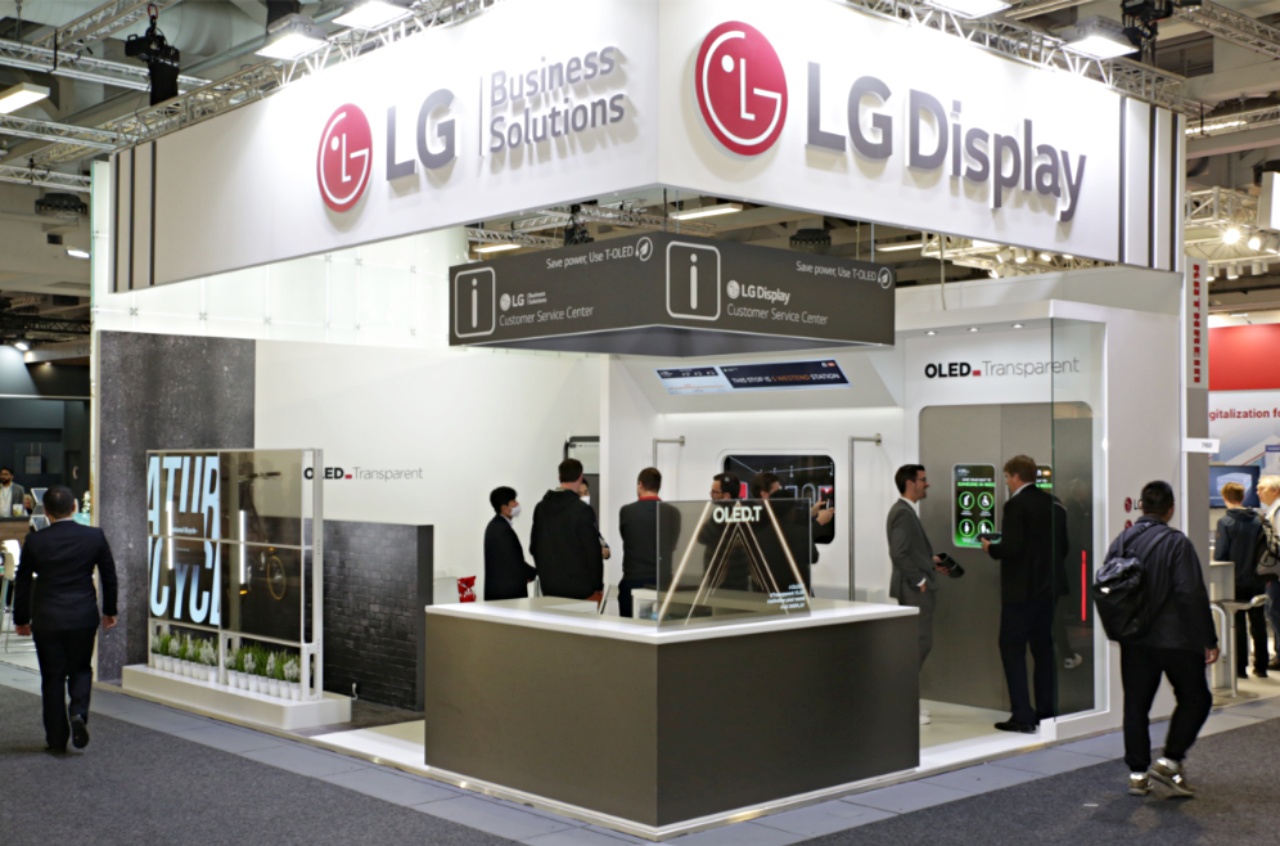

A business analyst also commented that the company may do better with its OLED business. This unit may grow fast and make up for the decline of its LCD biz. "In the second half of the year, it is expected that the company will make an operating profit of 900 billion won by improving the panel profit ratio and normalizing its OLED business thanks to the recovery of set demand," the analyst stated.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports