L3Harris Technologies is nearing a major transaction that underscores its strategic shift toward core national security and missile-focused operations. The defense contractor is close to finalizing a deal to sell a 60% stake in a portfolio of space and propulsion businesses to private equity firm AE Industrial Partners, according to people familiar with the matter. The deal, which could be announced as early as Monday, values the portfolio at approximately $845 million, with AE Industrial expected to pay more than $500 million for its majority stake.

Under the proposed agreement, L3Harris will retain a 40% ownership interest while divesting several space-related assets that primarily support NASA and commercial space activities. This move allows the company to sharpen its focus on defense priorities amid rising global demand for missile systems driven by the war in Ukraine and ongoing conflicts in the Middle East.

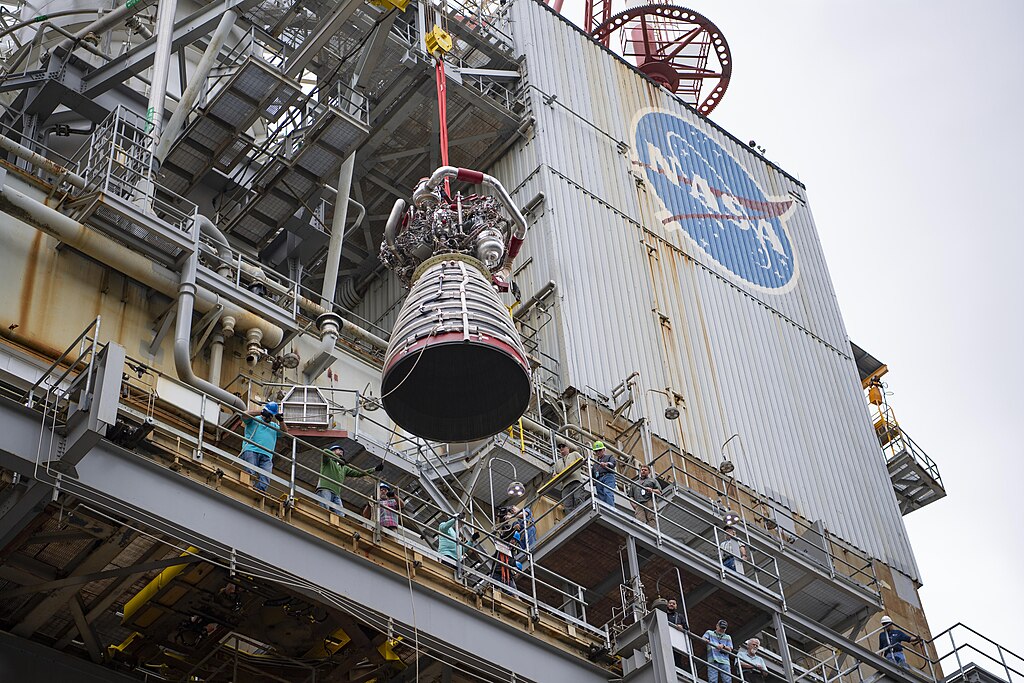

The space propulsion assets included in the transaction feature the widely used RL10 second-stage rocket engine, a critical component of United Launch Alliance’s Vulcan rocket program. The portfolio also includes in-space propulsion systems for satellite maneuvering, space launch electronics, and advanced nuclear power technologies designed for future lunar and Mars missions. L3Harris will, however, maintain full ownership of the RS-25 rocket engine, which powers NASA’s Space Launch System for the Artemis program, along with the associated facilities and workforce.

For AE Industrial Partners, the deal expands an already strong presence in the space and aerospace sector. Its existing investments include York Space Systems, Redwire, and Firefly Aerospace, positioning the firm to benefit from increased satellite deployment and emerging U.S. defense initiatives such as the Pentagon’s Golden Dome space-based missile defense concept.

L3Harris plans to use the proceeds to expand rocket motor and missile production capacity, fund general corporate initiatives, and potentially reduce debt. The transaction, expected to close in the second half of 2026 pending regulatory approvals, represents part of more than $4 billion in divestitures since the L3-Harris merger in 2018, reinforcing the company’s long-term strategy to streamline operations and prioritize high-growth defense markets.

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users