Korean exports fell 15.8% y/y in October, worse than expected, the largest decline in the headline rate this year, precipitated by large falls in shipments of petrochemicals, auto parts, steel and vessels, as well as high base last year.

On a seasonally adjusted m/m basis, exports fell 6.1% after climbing 9.1%, alternating between contraction and growth and a sign of fragile producer confidence in the global outlook.

There was also a strong element of payback in October, after strong September pre-shipments ahead of Chuseok and Golden Week holidays in China. Today's print confirms that the underlying trend remains soft, with overall exports down 7.5% YTD.

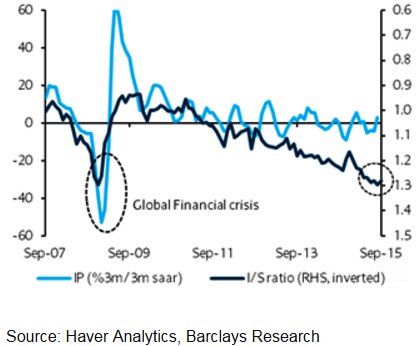

Indeed, on a per-day basis, October exports fell even more sharply, dropping 17.6% y/y, because this October had half a working day more. The key concern is still the high excess inventories, with the inventory/shipment ratio, which came in at 1.28x in September, remaining close to the 1.30x peak reached in December 2008 during the global financial crisis.

However, according to Barclays, beyond October, there are some positive factors seen that could sustain production in the last two months of Q4:

1) Stronger demand in the US for consumer electronics as the start of year-end festive demand is being approached

2) The gradual destocking of inventories

3) A ramp up in 3D memory chip output by Korean companies in China.

Some positive factors to sustain Korea's production

Monday, November 2, 2015 3:55 AM UTC

Editor's Picks

- Market Data

Most Popular

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record