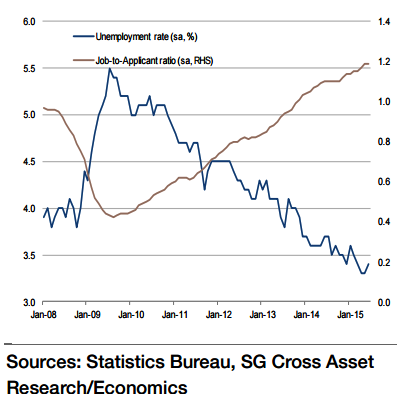

The number of job seekers that dropped out of the Japan's labour force increased in March and April, and these job seekers returned to the labour force in May and June. Most of them were absorbed by the increase in employment numbers.

"The Japan unemployment rate is expected to remain unchanged at 3.4% in July. Both the manufacturing and non-manufacturing sectors are feeling the labour shortage and are stepping up hiring. The unemployment rate is expected to continue to remain below 3.5%, corresponding to the NAIRU level. This in turn should underpin sentiment just as aggregate wages start to expand, thus enabling Japan to make a full exit from deflation", says Societe Generale.

However, if this situation fails to materialise, the BoJ's 2% price stability target will be difficult to achieve. The unemployment rate needs to fall below 3% for the target to be met, but this level currently seems very far away.

"The job-to-applicant ratio is likely to rise further to 1.20 in June from 1.19 in June. This is the highest level since 1992 and indicates that companies remain willing to increase their hiring", added Societe Generale.

Japan's July unemployment rate likely to be unchanged at 3.4%

Thursday, August 27, 2015 5:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock