The GDP data (-0.2%) for Q3 illustrated that Japan is in recession.

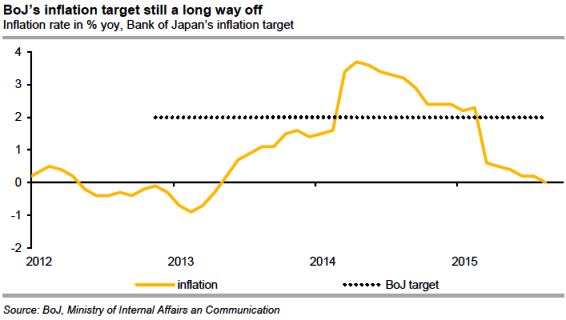

However, while the inflation rate remains at '0' because of which the BoJ cannot breathe a sigh of relief.

Unchanged unemployment claims were stubborn at 3.4% from previous.

If the economy is now also flagging the small flicker of hope that its inflation target of 2% could be reached by March 2017 is dwindling even further.

A tiny little positive signal on the inflation front is the GDP deflator that rose to 2.0% yoy. Even if it leaves everything unchanged at the moment, the BoJ will have to stand to attention.

The last meeting provided the perfect reason for this step as the BoJ corrected its growth and inflation outlook downwards.

As a result hardly any market participants expected the BoJ to take action today and it fulfilled this expectation.

In the end it can still wait and see and watch developments in USD/JPY once the Fed starts the normalization of its monetary policy.

However, it has become clear since Monday at the very latest that the BoJ will have no choice but to become more expansionary again.

Japan sliding into recession mode, 2% inflation target still a major concern for BoJ

Friday, November 20, 2015 9:33 AM UTC

Editor's Picks

- Market Data

Most Popular

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination