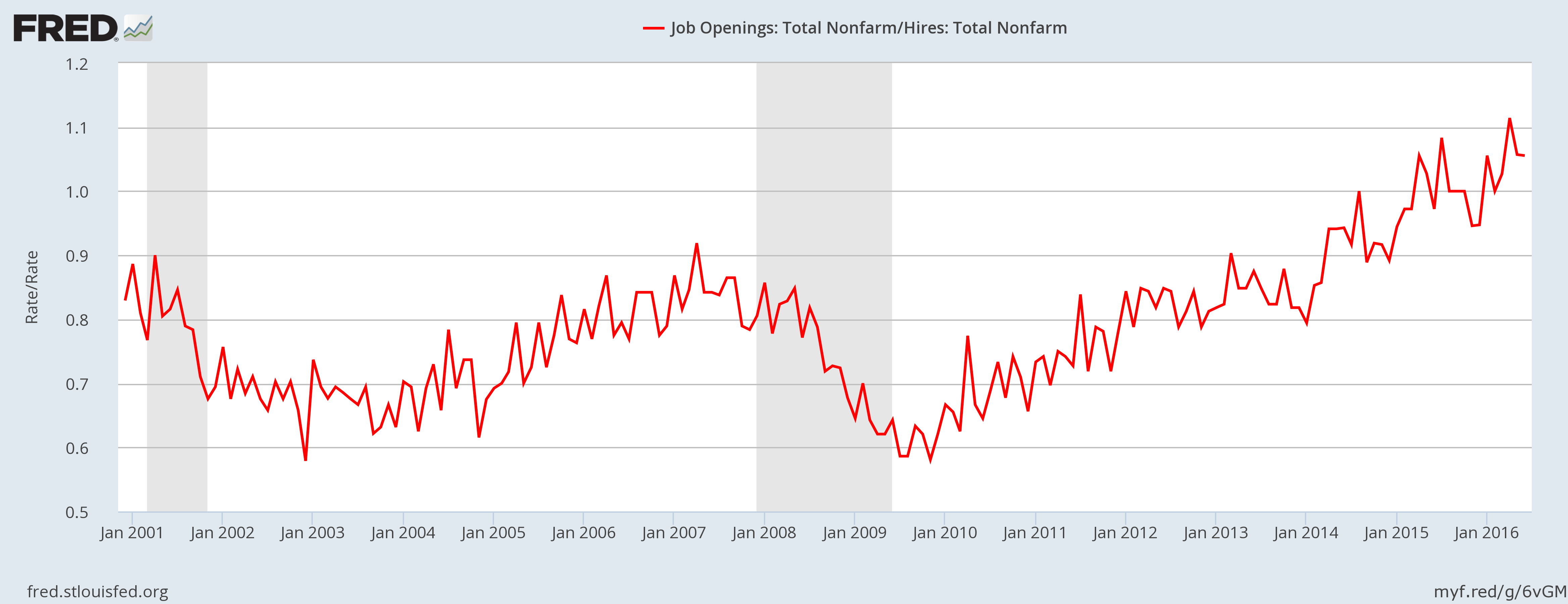

Latest data from JOLTS points at a deterioration in employment suitability ratio. This is a simple ratio calculated from the data of total job openings to total hires. Whenever the number reaches above 1, it means the economy is close towards maximum employability. It means that there are more job openings than hires, which basically means due to lack of suitable candidates, positions are not being filled. In the past 15 years of history (records go till 2001) this number has never gone above 1. This year, it has remained above 1.

This issue of structural unemployment can’t be solved by monetary easing. This could also lead to higher wages in some sections of the economy where the shortage of skilled labor is acute. The problem can be addressed mainly via two ways; one would be to introduce courses to improve skills and that would require some form of a fiscal stimulus cum reforms and the other one would be through immigrations, which is to bring in the skilled workers from outside. Given the political promises in this year’s election, the second one doesn’t seem to be an option and lawmakers in the U.S. don’t seem determined enough to pursue the reforms or the fiscal dosages needed. Hence this structural unemployment is here to stay in the States.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record