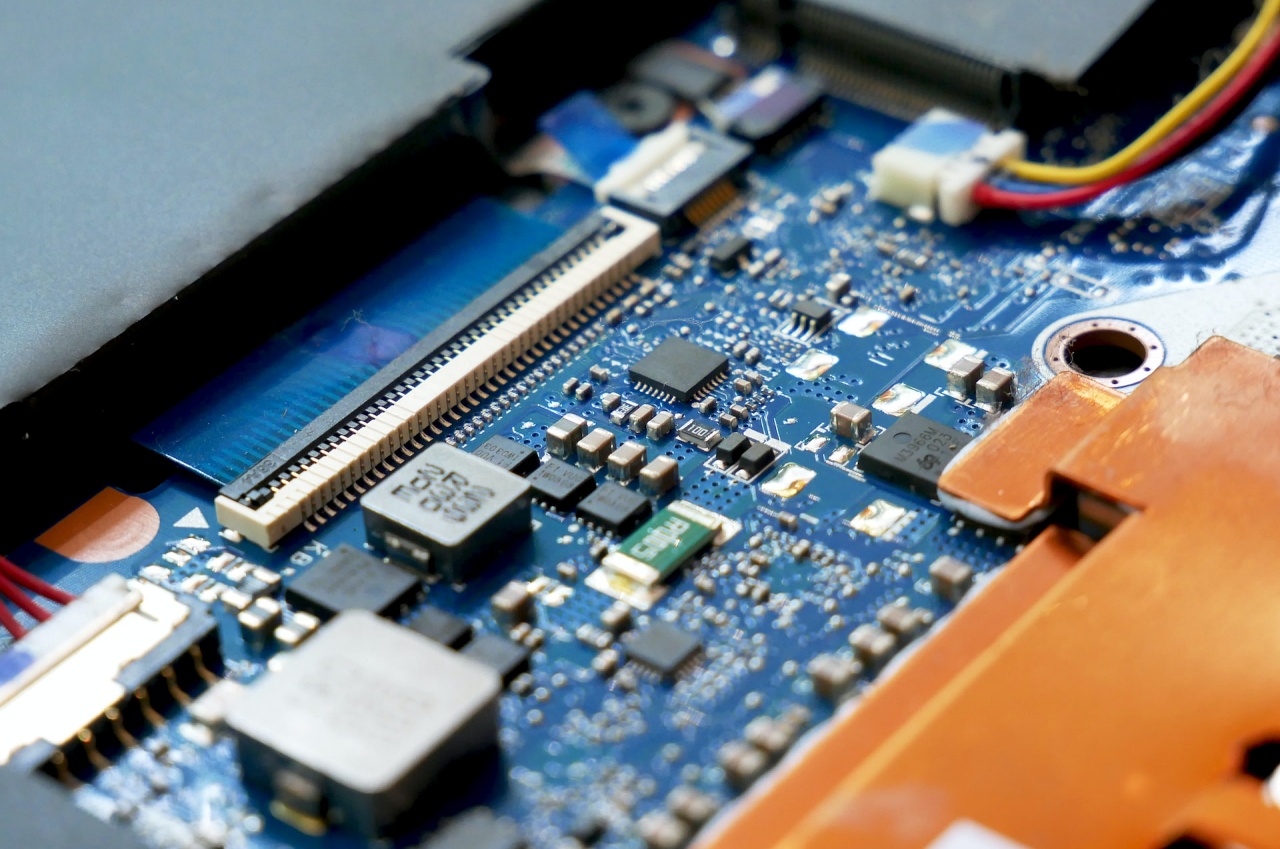

Japan Investment Corporation (JIC) remains focused on driving semiconductor sector consolidation through JSR, despite the chip materials maker posting a 209 billion yen ($1.45 billion) operating loss for the fiscal year ending March. JIC Capital CEO Shogo Ikeuchi reaffirmed the state-backed fund's goal of growing Japan’s global competitiveness by reorganizing the industry through strategic mergers involving JSR, which it took private in a $6 billion deal last year.

“Our goal was to take JSR private and, through a series of industry reorganizations such as mergers with rivals, significantly grow the semiconductor business and re-list the company,” Ikeuchi told Reuters. “That goal hasn’t changed.”

JSR, a key player in photoresist manufacturing, has undergone leadership changes and launched internal restructuring. However, its new CEO said the company is currently not ready for acquisitions. The company’s weak performance was mainly driven by its underperforming life sciences division, part of which is being sold to Tokuyama Corp for 82 billion yen.

The JIC-led buyout has stirred debate within the industry, with critics questioning the necessity and effectiveness of government-backed intervention in corporate restructuring. “Japan is a country where restructuring is structurally difficult,” Ikeuchi noted, acknowledging the challenge.

Founded in 2018 and overseen by Japan’s trade ministry, JIC aims to revitalize domestic industries through strategic investment. JSR maintains plans to return to the public markets within five to seven years, though Ikeuchi mentioned an earlier IPO could be possible depending on progress.

Resonac, a JSR rival, has expressed interest in participating once JIC exits. While Ikeuchi acknowledged the interest, he also cited Resonac’s high debt load as a factor to consider among various options.

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans