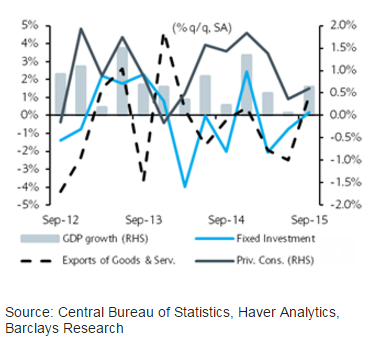

Israel economy posted a solid growth rate of 2.5%qoq in Q3 which was just 0.2% in last quarter. The growth rate is better than consensus' expectation of -0.9%. The economy printed an unexpected growth rate as the major components of GDP like exports, investments, and consumption improved in the quarter. At the same time inflation rate also soften to -0.7% y/y in October from -0.5% y/y in the previous month.

The Bank of Israel holds its policy rate at 0.10% and restrains its FX intervention. But as the Q3 growth recorded more than expectation, the pressure to tighten monetary policy will be may increase.

"We expect continued forbearance from the BoI. Nonetheless, the BoI will continue to lean against the ILS to improve the competiveness of Israeli exports. We retain our recommendation be short ILS", says Barclays.

Israel needs tighten monetary policy

Tuesday, November 17, 2015 4:35 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed