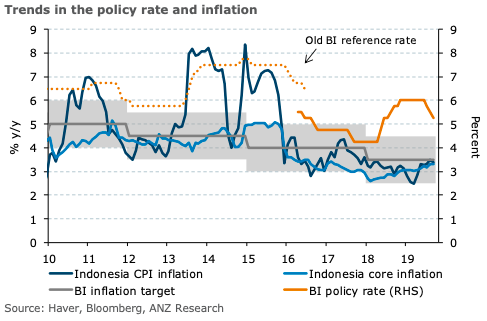

Indonesia’s headline inflation eased to 3.39 percent y/y in September, following two straight months of acceleration. A pullback in volatile food inflation more than offset a pick-up in administered prices and core inflation, ANZ Research reported.

On a sequential basis, headline CPI fell by 0.27 percent m/m in September, the first decline in seven months. The decline was led by food prices, which fell by 1.97 percent.

Most other major categories — such as housing, clothing, healthcare and education — saw prices rise further, but at a slower pace compared to the previous month.

Core CPI, which excludes volatile food and government-controlled prices, rose by 0.29 percent m/m in September, slower than the 0.43 percent gain seen in August. In y/y terms, core inflation edged up to 3.32 percent, the highest since February 2017.

The bottom line is that both headline and core inflation are likely to stay comfortably within the central bank’s 2.5-4.5 percent target band and will not prevent BI from easing monetary policy.

"We continue to see scope for at least one more 25bp cut in BI’s easing cycle, which will take its policy rate to 5.00 percent by end-2019," the report further commented.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment