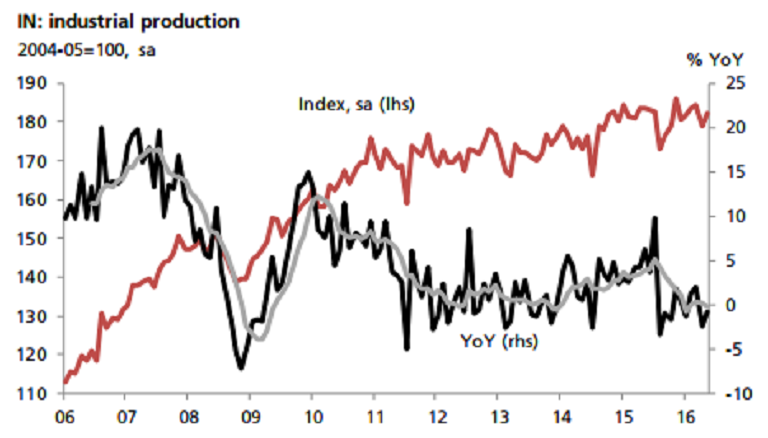

Industrial production in India declined during the month of August, tracking weakness in the country’s manufacturing sector. Moreover, production trends yet so far this fiscal year have disappointed, pointing to an extended lull phase for private sector investments.

India’s August industrial production came in at -0.7 percent y/y from a revised -2.5 percent in July. This takes Apr-Aug pace to -0.3 percent, weaker than 4.1 percent in the comparable period last year. Mining and manufacturing output declined while electricity generation was modestly positive (Aug 0.1 percent y/y).

Weakness in the manufacturing component in particular was distorted by a sharp 49 percent fall in electrical machinery/ apparatus, alongside a slide in food products. Under the use-based breakdown, capital goods extended its slide for the tenth consecutive month, at -22 percent. Weak base effects are likely to hurt this component until October this year. A modest pick-up in non-durables helped prop consumer goods output.

Meanwhile, markets will look for a rebased industrial production series due late-2016 or early next year, to update the data series and bring it in line with the rebased GDP dataset.

"We expect FY17 GDP growth to average 7.8 percent this year, lifted by higher farm output, consumption demand and public sector investments," DBS commented in its latest research note.

Revival in the private investment cycle is likely next fiscal year, as demand catalysts take effect and existing capacity is absorbed. Price pressures in the interim are likely to stay close to the target this year but pose upside risks in FY17-18.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility