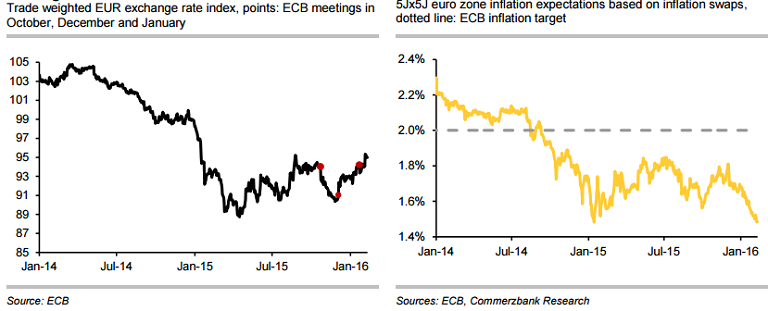

The Euro is trading around its strongest level since late October, this despite the ECB's easing measures at the December meeting. ECB President Mario Draghi may blame himself for the reaction of the EUR exchange rates. The ECB passed a less far reaching package of measures in December knowing very well that the market was expecting more. The markets were clearly disappointed with the surprisingly timid easing which was clearly evidenced in the massive shorts' squeeze soon after the meeting. Also, the euro has a tendency to rise in times of stress, and in the current global scenario, it is likely to continue to appreciate. In particular while risk aversion remains high, the currency remains in demand as a safe haven. The question now is how much of the euro's appreciation will the ECB tolerate.

The long term inflation expectations in the euro zone have been collapsing since the start of the year. Eurozone inflation hit its highest level in January since October 2014-but still stands at just 0.4%. Despite moving in the right direction for the European Central Bank, some indicators are proving less responsive to Mario Draghi's latest efforts. The latest decline in oil prices is likely to mean a setback for headline inflation. The five-year/five-year inflation swap, an admittedly flawed measure of market expectations for medium-term inflation, has continued to fall.

With the Euro appreciating everyday, a far reaching package of measures is becoming increasingly likely. Italian finance minister Padoan was on the wires on Monday stating the ECB policy tool is a key tool for the Eurozone and shall contribute to inflation rise. However, investors may be proving more skeptical of Mr. Draghi's words, given the scale of December's disappointment. The ECB will next meet on March 10 and expectations are for the central bank to cut its deposit rate to -0.4 from -0.3 percent.

"The recent bounce in oil prices is of limited consolation for the ECB, as inflation expectations have not seen a similar rise. More monetary stimulus will be in store in March." said Nordea economist Jan von Gerich

The development of the past few weeks has shown that compared with the ECB the Fed is able to weaken its currency much more effectively at present. Despite the Fed sticking to its plans to hike interest rates in principal, just the fear of the market that they may change their mind caused notable USD depreciation over the past few days. It shows that the Fed would find it very easy at present to weaken its currency if it wanted to. EUR/USD was trading at 1.1260 at 0930 GMT, while EUR/GBP was at 0.7778 levels.

How much euro appreciation will the ECB tolerate?

Wednesday, February 10, 2016 10:18 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?