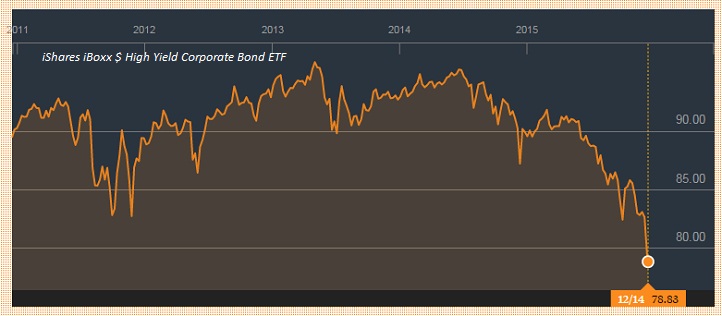

High yield credit market is going haywire this year and investors worry, it could be worse in 2016, as rates rise in US, led by first hike tomorrow, by FED reserve. Years of cheap credit has been used to fund projects, especially in the commodities segment, which are not viable at current price. Even, shale drillers in US, struggling to cope with gas price falling to 14 year low, while oil is just inches away from crisis era (2008/09) low.

Last Friday, FRED released a figure, which showed average yield in US high yield debt is inching towards 9% heading into FOMC tomorrow, a level not seen since 20011/12 European debt crisis. Average yield on energy high yield debt is around 14%. Both of these were around just 4% in early 2014.

After positive return since 2009 financial crisis, high yield debt return have fallen to negative in 2014 and worsened this year.

Investors' worrying on US rate hike and liquidity have withdrawn massively from the credit funds focused to high yield debt instruments. Further withdrawal likely to exacerbate the trend. Since 2009, stricter financial regulations, led by Dodd-Frank, led investment banks to reduce their bond portfolio and move away from their traditional rose as market-maker. So some worry, FED hike could lead to greater liquidity disruption in the market.

Last night, HYG and CNK, two biggest high-yield bond ETF dropped to their lowest price in six years. US asset manager, Third Avenue, rattled by loss this year and heavy request for investor withdrawal has decided to shut down ad liquidate its $788 million holdings. Stone Lion Capital Partners, a US based hedge fund said on Friday that it is barring redemption in its $400 million credit funds.

Lucidus Capital Partners, another hedge fund is the latest to announce complete wind up of its $900 million fund, in wake of worst return this year and investor withdrawals.

Situation is likely to get worse in 2016.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed