What is clear today though, is that the short-term pre-FOMC risk is of a break higher in EUR/USD for no obvious reasons than positions reduction, upon resultant forces Euro's gains against dollar to reach at 1.11 areas. Buying one touch binary calls would determine huge yields for sure.

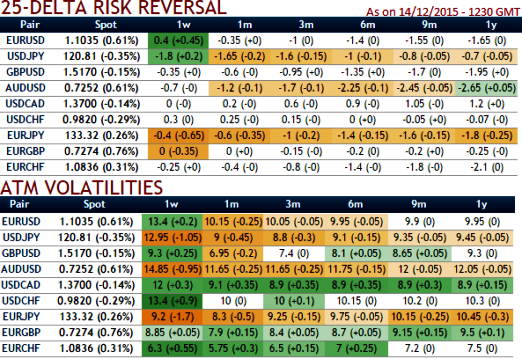

On the contrary, with spot FX flashes of EURUSD at 1.1025 we see delta risk reversal for 1 week contracts have shown slight recovery signals but long term (1M-1Y) put contracts are on higher demand.

EURUSD has been in the list of top 3 pairs to perceive highest implied volatility of 1W at the money contracts among G20 currency space, almost close to 13%.

More importantly, the contracts of this pair for 3m-1y expiries show gradual increase in negative sentiments. So, from this computation what we could read is that EUR may gain until tomorrow's Fed's rate decision and thereafter eyeing on Yellen's statements we could foresee dollar's appreciation as quite certain event.

As a reminder, this higher IV represents how much movement today's FX market expects from EURUSD during US sessions and the life span of the option. In that respect, an option buyer is partially buying the market's expectations for this pair.

We would like to buy long term put back spreads contemplating the 25 delta risk reversals as the EURUSD's broader perspectives are weaker in long run.

If more price actions occur at the fat tails, the option trader will mark volatility higher for out-of-money (OTM) and in-the-money (ITM) options then at-the-money (ATM) options and so does happen with EURUSD pair currently.

FxWirePro: Speculate EUR/USD with binary calls pre-FOMC - Buy risk reversal in long term

Tuesday, December 15, 2015 10:53 AM UTC

Editor's Picks

- Market Data

Most Popular