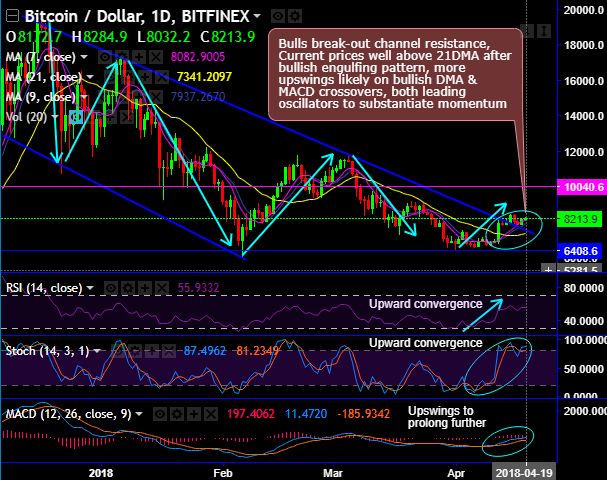

On daily plotting, BTCUSD was sliding through sloping channel, but bulls, for now, has managed to have broken out the channel resistance.

Strong support was taken at $6,408 levels. Ever since then bulls have held very convincingly.

The bullish engulfing pattern was also spotted out at $7,912 levels to spike off the rallies.

Consequently, the current prices have gone well above 7DMA after the bullish engulfing pattern, for now, more upswings seem to be likely on bullish DMA and MACD crossovers.

While both leading oscillators substantiate the healthy bullish momentum on this timeframe. RSI and stochastic curves converge upwards to the ongoing rallies to signal the strength and intensified bullish momentum in the minor trend.

On the contrary, the weakness still seems to be persisting in the intermediate trend event though bulls are holding stronger at $5,958 levels, the current prices are still restrained below 7EMAs with bearish crossovers (weekly terms).

Both leading and lagging indicators on this timeframe are still signaling the selling sentiments.

Both trend indicators (EMAs and MACD) are substantiating the bearish stance, the downswings seem to be prolonged further.

Dan Morehead, the operator of Pantera Capital (one of the most prominent crypto hedge funds on the planet), vouches that Bitcoin has grasped the bottom of its bear trend, and that now is the right time to buy BTC. On the contrary, the bitcoin dust doesn’t seem to be settled as the BTC protocol sometimes needs to generate tiny output coins when users send bitcoin back and forth, coins so small in value they require more fees to spend than they are essentially worth.

With reference to our previous write-up, we could foresee the stiff resistance at $8,388 levels (i.e. 55EMAs). Hence, one can wait until a decisive breach of these levels, however, an aggressive BTC bull can prefer CME BTC futures contracts for May month delivery which is trading +15 rather than the spot BTCs.

CME CF Bitcoin Reference Rate (BRR) and CME CF Bitcoin Real-Time Index (BRTI), a standardized reference rate and spot price index with independent oversight are accelerating the professionalization of bitcoin trading. BRR and BRTI launched November 14, 2016. Several bitcoin exchanges and trading platforms will provide pricing data, including Bitstamp, GDAX, itBit, and Kraken. Source: CME

Currency Strength Index: FxWirePro's hourly BTC spot index is flashing at 31 levels (which is bullish), while hourly USD spot index was at -7 (neutral) while articulating at 12:27 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data