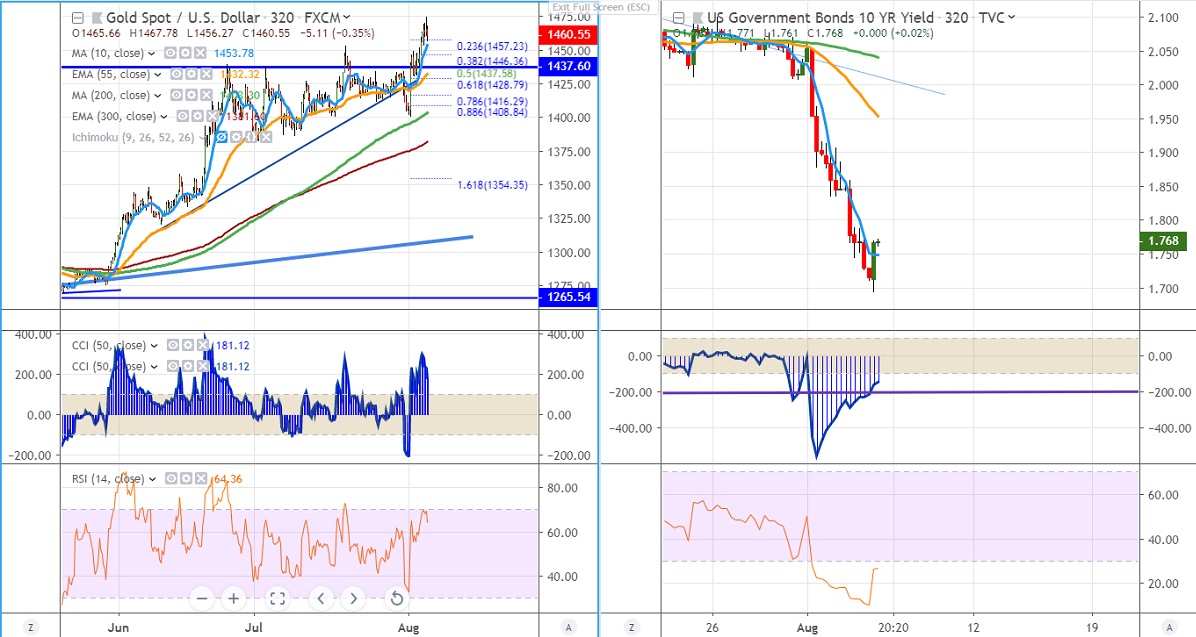

Candlestick pattern- Shooting star

Gold has halted its 2-1/2 month jump and declined more than $15 from high of $1474.The yellow metal was one of the best performing asset in past 4 months and jumped more than $200 on US Fed rate cut and escalation of US-China trade war.

US 10 year bond yield shown a good recovery of more than 4% after hitting 1.74% lowest level since Nov 2016.It is currently trading around 1.769%.

On the higher side, near term resistance are around $1475 and any break above targets $1500/$1525.

The near term support is around $1456 and any violation below will drag the yellow metal to next level till $1440/$$1432. Major weakness only below $1400.

It is good to sell on rallies around $1465-66 with SL around $1475 for the TP of $1432.