Gold showed a minor sell-off due to profit booking. It hit an all-time high of $2954 and is currently trading around $2940.

ETF Demand Surges on Economic Woes

Demand for gold-backed ETFs has risen to near five-year highs due to economic uncertainty, geopolitical tensions, and safe-haven asset flights. Stress over potential U.S. tariffs and general economic uncertainty has driven investors to gold, leading to huge inflows in physically backed gold ETFs and rising assets under management. Increased world tensions and volatile markets also supported risk aversion as investors sought refuge in gold ETFs. Gold ETF inflows for January 2025 were at a record high, with significant increases in India and abroad, as investors continued a general pattern of portfolio diversification and safe-haven-seeking

Rate Pause Expectations Diminish

According to the CME Fed Watch tool, the chances of a rate pause on the Mar 19th, 2025 meeting have decreased to 95.50% up from 97% a week ago.

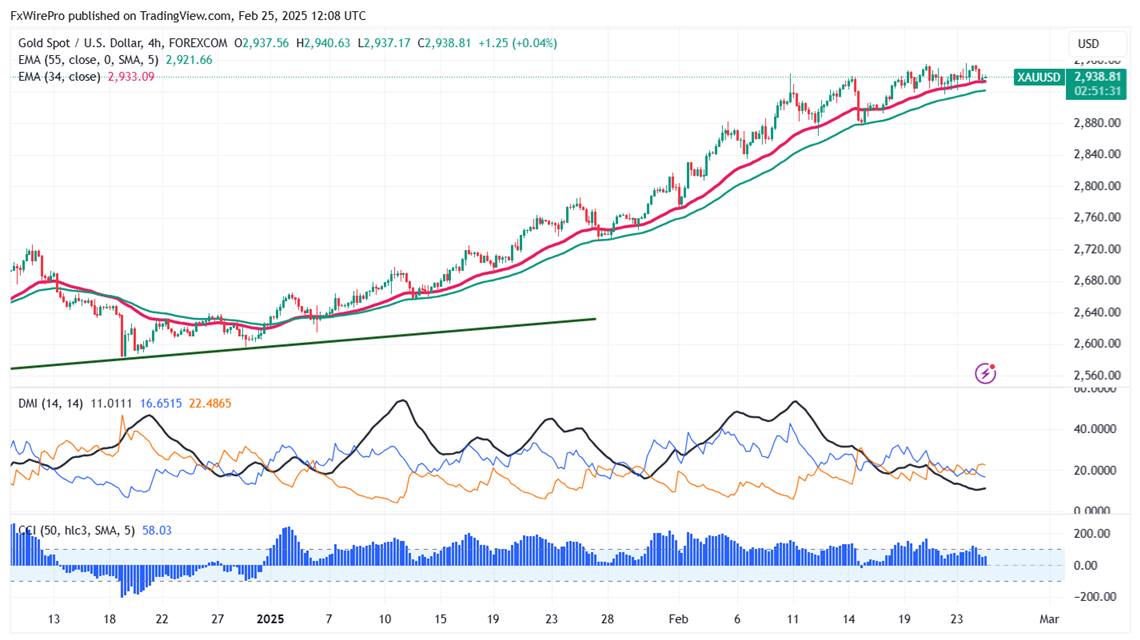

Technical Analysis: Key Levels and Trading Strategy

Gold prices are holding above the short-term moving averages 34 EMA and 55 EMA and long-term moving averages (200 EMA) in the 4-hour chart. Immediate support is at $2920 and a break below this level will drag the yellow metal to $2890/$2875/$2860/$2850/$2830/$2800/$2770/$2740. The near-term resistance is at $2955, with potential price targets at $2957/$3000. It is good to buy on dips around $2890 with a stop-loss at $2870 for a target price of $3000.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?