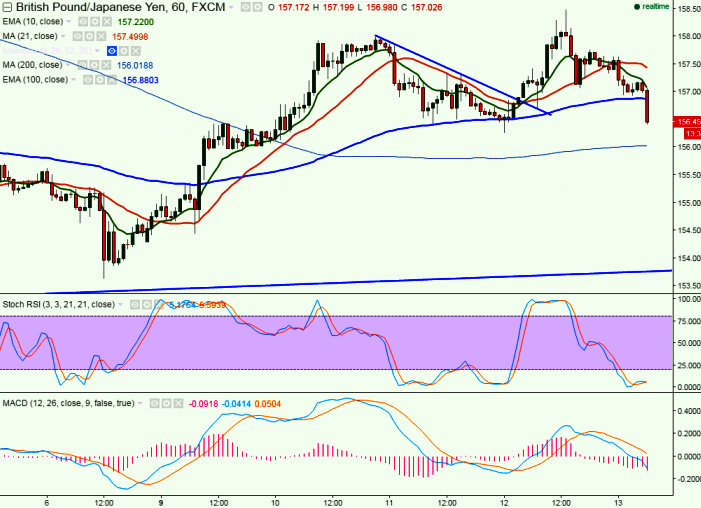

- Major support -156 (200 day HMA)

- Major resistance -158.50

- GBP/JPY has retreated after making a high of 157.48.It is currently trading around 156.91.

- Minor weakness can be seen only below 156. Any indicative break below 156 will drag the pair down till 155.50/155.25/154.40.

- Short term bullish invalidation only below 153.50.

- On the higher side any break above 157.20 (10 day EMA) will take the pair to next level till 158/158.50/159.

It is good sell below 156 with SL around 157.20 for the TP of 154.40/153.50.

R1-157.20

R2-158

R3-158.50

Support

S1-156

S2-154.40

S3- 153.50