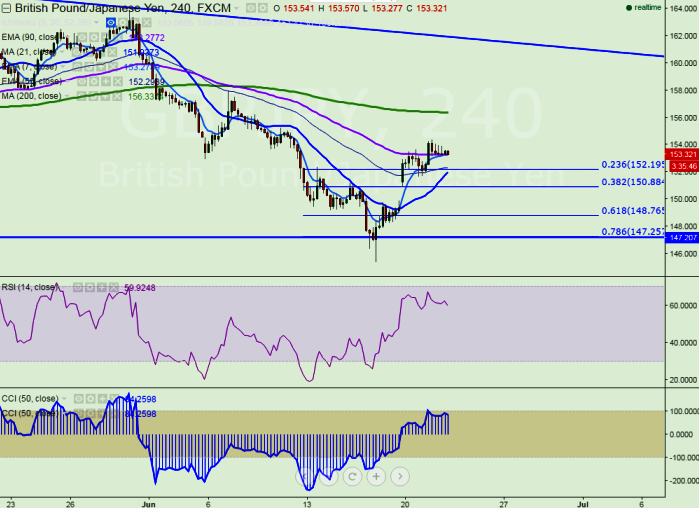

- Major Resistance- 154.47 (7 W EMA)

- Major support – 153 (4H Tenkan-Sen)

- The pair has made a high of 154.38 yesterday and started to decline from that level. It is currently trading around 153.55.

- GBP has been trading higher against all major pair’s for past four trading sessions on hopes that Britain will stay in EU. The latest ORB’s final poll results with Remain 54%, Leave 46% and another poll by Number Cruncher Politics shows Remain at 63% and Leave at 37%.

- The Intraday trend is slightly bearish as long as resistance154.40 holds.

- Any violation below 153 will drag the pair down till 151.60/149.90.

- On the higher side , any indicative break above 154.40 will take the pair to next level till 155/156.15.

It is good to sell below 153 with SL around 154.38 for the TP of 151.60/149.90