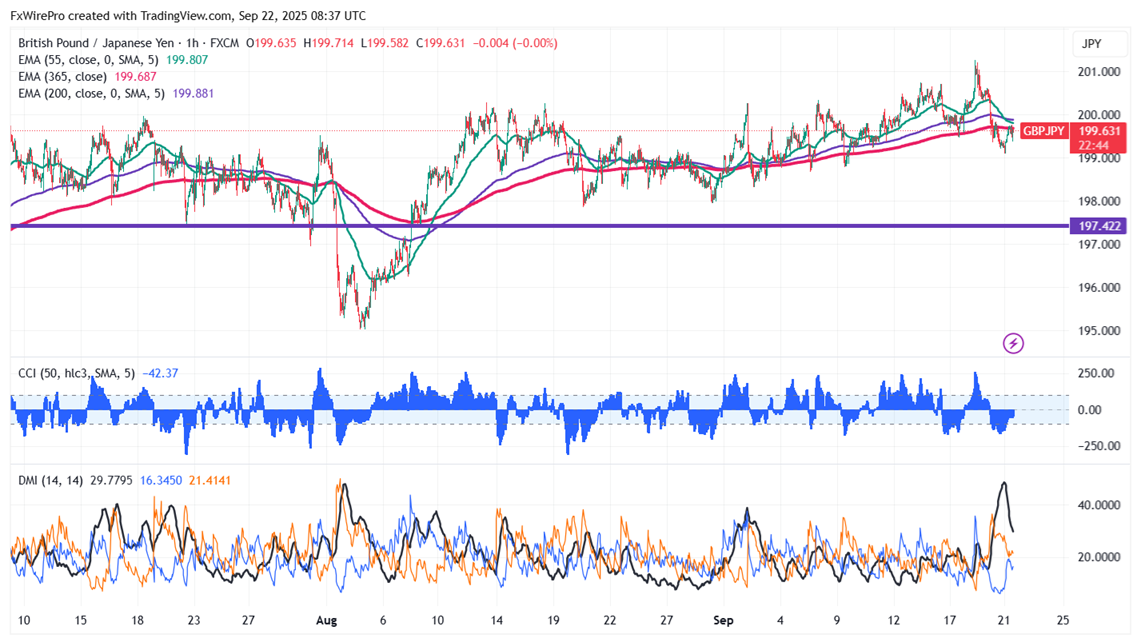

GBPJPY traded in a narrow range between 201.26 and 199.11 for the past three days. The intraday trend is bearish as long as the resistance at 200 holds. It is currently trading around 199.614; the pair reached an intraday high of 199.76.

The pair is trading below 55, 200 EMA, and 365 EMA (long-term) on the 1-hour chart, confirming a bearish trend. Any violation below 199 indicates the intraday trend is weak. A dip to 198.75 /198/197.85/197.25/ 196.70/196.20/195 is possible. Immediate resistance is at 200 a breach above this level targets of 200.53/201.26/ 202/203.

Market Indicators ( 1-hour chart)

CCI (50)- Bearish

Directional movement index - Neutral

Trading Strategy: Sell

It is good to sell on rallies 200 with SL around 201 for a TP of 197.25.