The Turkish lira was buoyed by the some constructive news-flow from around the region. We have maintained that the lira’s prospects very much depend on how quickly Turkish exports will pick up as lockdowns ease across Europe. This source of FX revenue would far dominate any swap deal the government can sign with any other central banks. The significant bounce in the German Ifo for May represents better prospects. The outlook for the lira would be materially improved if developed-EU were to steadily recover from here without a second virus spike. Given that stabilisation came sooner than we had feared, the likelihood has increased that USDTRY will head back to the 6.25 region in the coming weeks.

Meanwhile, the lira also received some boost from CBT hiking the limit for lira swap transactions to 50% from 40% (this was raised from 30% to 40% earlier in May) as part of its various interventions. However, the upside risks of USDTRY remain intact and suitable hedging vehicles have been positioned accordingly.

OTC Updates & Hedging Strategy:

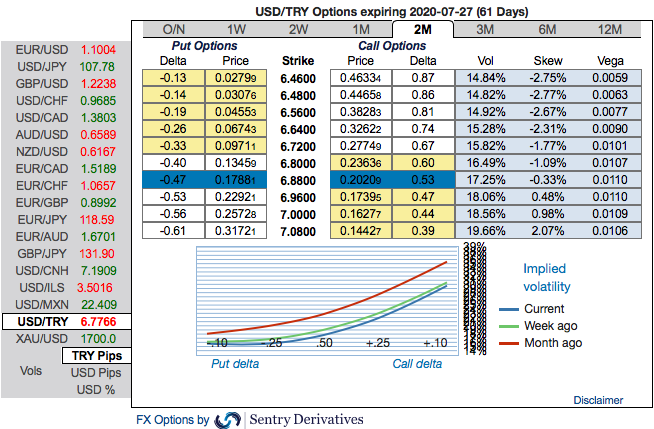

On hedging grounds, capitalizing on prevailing price dips and above driving forces, when USDTRY was trading at 6.4511, we already advocated 2m debit call spreads with a view to arresting momentary downside risks and upside risks in the major trend. The current spot reference: 6.7766 level, initiated 2m 6.05/7.08 call spreads at net debit. One can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The skewness 3m IVs are indicating upside risks, higher bids for OTM calls are hedging bias towards upside risks (refer above nutshell).

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favour. Courtesy: Sentry & Commerzbank

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?