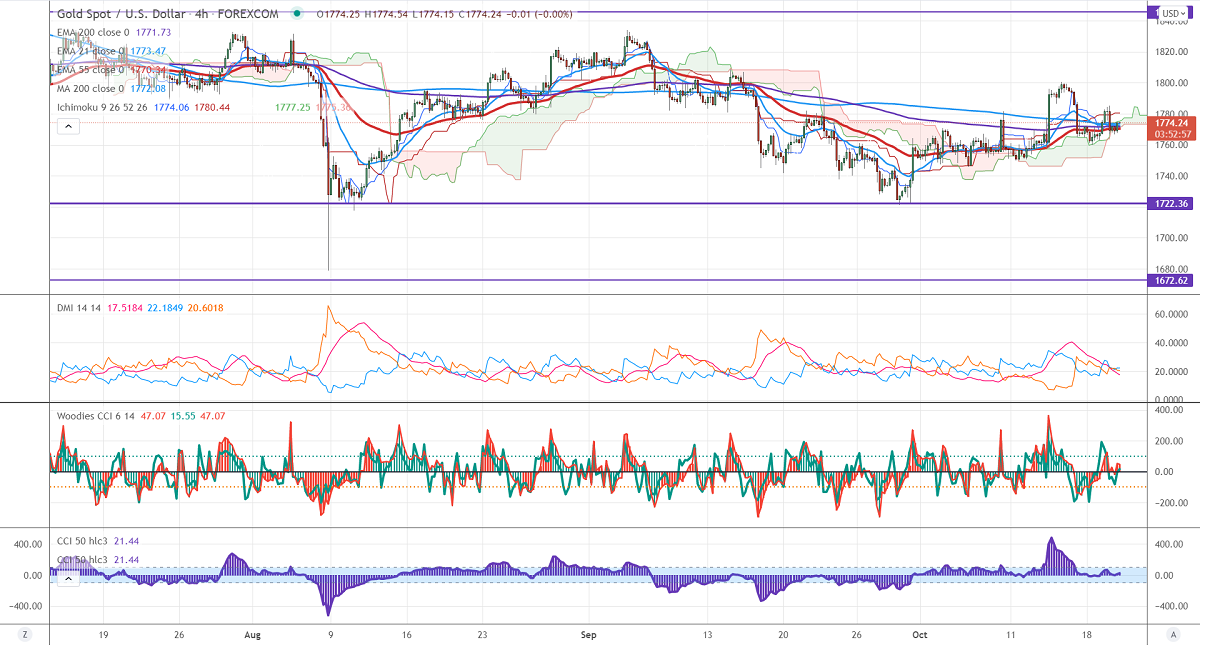

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1777

Kijun-Sen- $1797

Gold trading flat for the past three weeks and struggling to close above $1800 despite the weak US dollar. The surge in inflation has increased the chance of bond tapering by Fed. The upbeat market sentiment and decline in US treasury yield also support the yellow metal at lower levels. The US dollar index hits three weeks low, any breach below 93.50 confirms further bearishness. Gold hits a high of $1774.68 and is currently trading around $1780.Markets eye US CPI data for further direction.

Factors to watch for gold price action-

Global stock market- Slightly bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- bearish (positive for gold)

Technical:

It is facing strong support at $1740 violation below targets $1720/$1700. Bearish continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal $1825/$1835/$1860/$1900 is possible.

It is good to sell on rallies around $1785-86 with SL around $1800 for TP of $1720.