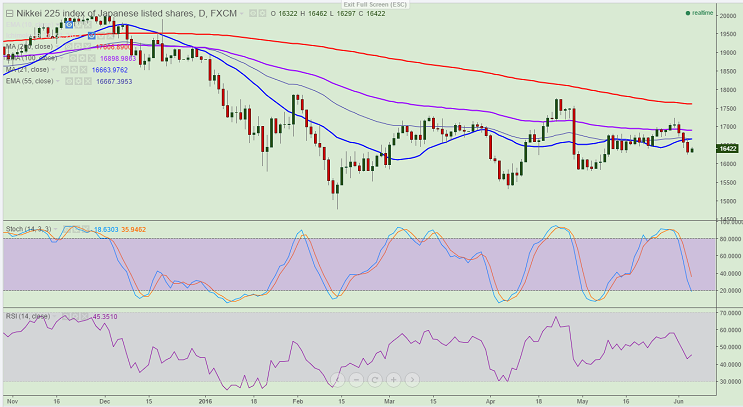

- Major support - 16,250 ( 50% retracement of 1770 and 14770)

- Nikkei Index has has broken minor support 16410 and declined till 16252 on Friday due to weaker than expected US Non-farm payroll. It is currently around 16432.

- Short term trend is slightly weak as long as resistance 17000 holds.

- The index major resistance is around 16650 (21 day MA) an any break above will take the index to next level 17000/17250.

- On the lower side major support is around 16,250 (50% retracement of 14770 and 17770) and break below targets till 16,000/15,800 in short term.

- Short term trend reversal can be seen only below 15,000.

It is good to sell on rallies around 16700-750 with SL around 17000 for the TP of 16250/16000