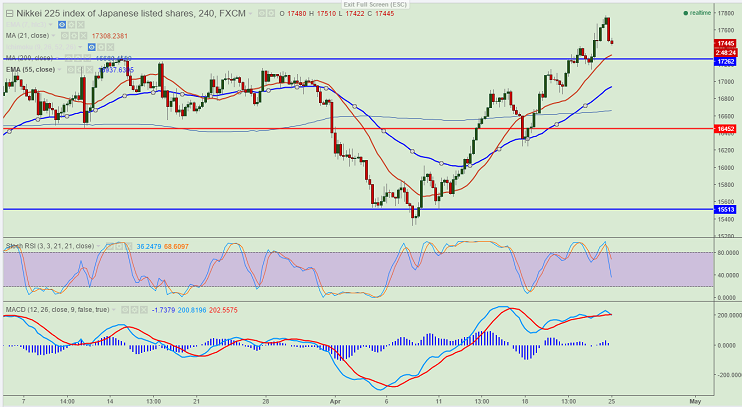

- Major resistance - 18150 (200 day MA)

- The index has retreated after making a high of 1770. It is currently trading around 17445.Short term trend is slightly bearish as long as resistance 18150 holds.

- The index major resistance is around 18150 and any break above will take the index to next level 18300/18500.The minor resistance is around 17898 (Feb 1st 2016 high).

- On the lower side major support is around 17200 and break below will drag the index down till 16900/16650 (200 day 4 HMA) in short term. The minor support is around 17500 (7 day 4 EMA).

- Short term weakness can be seen only below 15000.

It is good to sell on rallies around 17800 with SL around 18150 for the TP of 17400/17200/16900.