The ZAR has strengthened against the US dollar (since mid-January, the ZAR has strengthened by 7%) despite domestic uncertainties and weak global risk sentiment.

Credibility is running low because South Africa finances tend to be rock solid due to the political uncertainties (President Zuma replaced his Minister of Finance twice in the recent times) and potential rating downgrade will weigh on the ZAR in our view over the next months but may be neutralised by the impact of a more dovish FED and higher commodity prices.

Over the medium term, we see ZAR strengthening, as the ZAR is fundamentally undervalued after years of weakening. As a result we forecast the USD/ZAR to trade slightly around 15.50 in 3-6M and then strengthen somewhat to 15.00 in 12M. However, we caution the outlook is very uncertain given political risks.

Hedging perspective:

Although, technically USDZAR has shown weakness, we look ahead for fundamental stabilities as the frequently changing finance ministers likely worried investors overexposed to the local bond market. We therefore reached USD/ZAR levels we have forecasted for the end of Q2' 2016 at around 15.50 range.

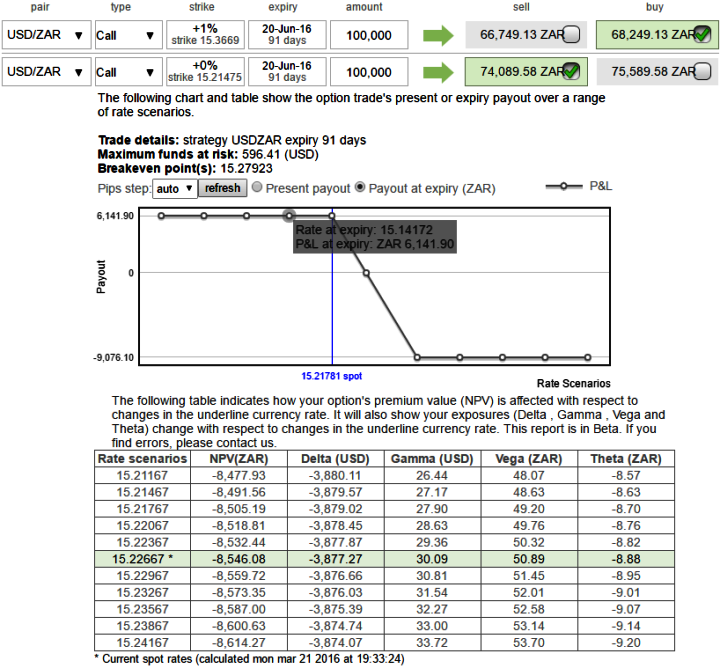

We believe the dust may settle now but would maintain a bearish bias because headline inflation may increase in the near future on seasonality and the current account deficit remains a concern. We advocate to buy the diagonal spreads ahead of downside pressures and dubious eyes on continuation of long term uptrend.

Hence, go long in 3M (1%) OTM delta call while shorting 2W ATM call with positive thetas for time decay advantage on shorter tenors on short side. Use accurate expiries as stated above (the expiries used in the diagram are for demonstration purpose only).

The strategy can be back tested using option greeks before execution.