AUD finished 2017 as the fifth best performing G10 currency against the USD, surpassed only by European currencies (EUR, DKK and SEK) and Sterling. This was a reasonably good performance for a currency whose economy remains desynchronized from the global upswing and whose central bank is firmly on hold with the policy rate sitting at a historical low. In 2018, we expect AUD’s ranking within the G10 to slip a few places; we are forecasting a steady decline towards USD0.72 by year end.

AUDUSD below 0.75 if:

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labor market;

2) The Fed responds to firm labor market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises as financial conditions tighten.

While AUD has been a strong USD-hedge candidate since one-touch AUD put pricing benefits from wafer thin forward points and risk-reversals that renders negative carry of AUD selling almost negligible, and the underlying itself provides fundamental diversification for the broad reflation theme given Australia’s unique domestic headwinds, as well as useful equity beta should the breakneck rally in stocks hit a roadblock.

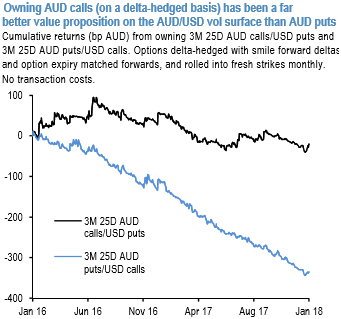

That AUD is worth selling via options does not necessarily imply we find AUD risk-reversals “cheap” enough to warrant owning vanilla AUD puts outright, (please be noted that mounting bearish sentiments in 3m tenors and these sentiments remain intact in 9m & 1y tenors, refer above nutshell) – indeed, recent spot-vol correlation in AUDUSD has been sharply positive (spot up, vol up) in defiance of the persistent bid for AUD puts on riskies, indicating much better value in owning AUD calls rather than puts on the surface (refer above chart).

In light of this, the reduced risk-reversal sensitivity of one-touches is preferable to vanillas while still retaining healthy mark-to-market P/L sensitivity to spot moves. Off spot ref. 0.8070, consider 2M 0.77 strike AUD put/USD call one-touches for 20.7% indicatively.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 15 levels (which is neutral), while hourly USD spot index was at a tad below 100 (highly bullish) at the time of articulating (at 07:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields