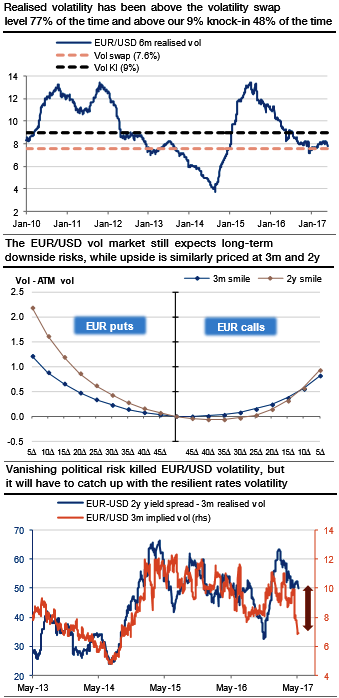

As the FX market’s focus returns to monetary policy, its relationship with interest rates will become more prominent. The last time that FX vol was durably in a low regime coincided with a period when central bank policies were more accommodative than today. This depressed the volatility of the EUR-USD rates spread, which is a powerful driver of EURUSD volatility (refer above graph). However, we are now observing a break of the correlation between FX and rates volatility, with EURUSD vol under pressure but rates vol remaining supported.

In our view, relative rates volatility currently better captures central bank stances than EURUSD volatility. Lastly, FX vol has been extremely focused on short-term political risk, and its valuation has diverged from its medium-term pattern. As the market now sees reduced political fears and is refocusing on the modalities of ECB tightening, the case for more Euro bullishness and more volatility is resurfacing.

The options market is pricing that implied volatility will not really move if the FX rate moderately appreciates (see the smile on above graph). A 6m volatility swap can be currently traded at 7.6%, which is cheap by historical standards since 6m realized volatility has been higher than that for 77% of the time since 2010.

Over this period, the median realized volatility has been 8.8%, and thus volatility was below this level for half of the time and above it for half of the time (refer above graph). In our view, it is very likely that both the euro and its volatility will rise, possibly involving a change in the direction of the skew.

We, therefore, recommend buying a 6m EURUSD call strike 1.15, conditioned by realized volatility being above 9% at the maturity. This option costs 0.60% in current market conditions (spot at 1.1208), saving about 1% on the vanilla.

This exotic option takes advantage of the odds, since it costs 38% of the vanilla, while the past distribution of the realized volatility suggests that this knock-in condition at 9% has about a 50% probability. According to our fundamental analysis, the actual probability of activation could be even higher.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields