Our highest conviction macro trade in recent weeks has been short GBP as we felt that UK rate hikes were overpriced given the weak starting point for UK growth and the existential Brexit shock that continues to dominate the medium-term outlook. The rate market has belatedly begun to rethink its scenario of a relatively normal rate hike as a result of more equivocal commentary from the BoE and the absence of lift in the growth numbers. Next week’s 3Q GDP print is expected to confirm the UK as the clear growth laggard within G10, and so maintain the sense of drift in rate expectations and GBP.

It’s important to recognize that a less assertive BoE outlook is not the only factor weighing on GBP. In particular, the GBP TWI has now given back 80% of the gains it made following the hawkish September MPC whereas the rate market has retraced by less than a third (based on the Dec 19 short-sterling contract).

This disconnect might suggest that GBP is over-reacting; however, it simply reflects the additional leverage of GBP to the lack of progress in the Brexit talks and the increased risk of an accidental no deal. The substance of the EU Council's summit conclusions on Brexit –that the EU would begin preparatory internal discussions on trade and transition, but further progress would be needed on 'phase one' issues for those talks to include the UK –has been clear for at least a week or so.

While we expect talks on a transition deal to begin after the December summit, the atmosphere around the negotiations will remain very uncomfortable in the interim and a probable source of intermittent friction for GBP.

Technically, the break below the August high at 1.3267 in Cable increased the risk of having potentially resumed the long-term downtrend but as long as key-support between 1.3020 and 1.2942 to 1.2776 (weekly trend/Dec. 2016 high) is cushioned we at least see room for a stronger countertrend rally to 1.3509.

Long a 2m 0.8950 - 0.9150 EURGBP call spread. Paid 52bp in the recent past. Marked at 81.6bp.

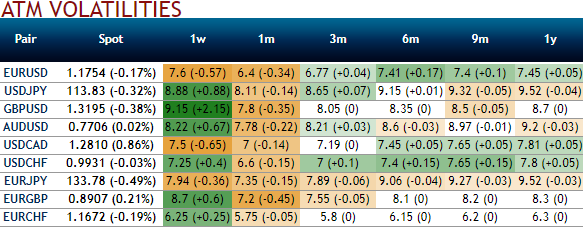

The range of spot outcomes on cable has now opened up from a previously narrow 1.28-1.30 band to a much wider 1.28 -1.36 (or higher) which ought to command a higher premium in implied vols than before. Yet GBP implied vols have retraced 3/4ths of the ramp up from earlier this month, and recent realized vols are clocking 1 vol above short dated implieds, hence this appears to be a case of underpriced fundamental uncertainty with supportive technicals for gamma ownership.

Nevertheless, EURGBP’s recent correction looks very warranted and the GBPUSD bounce looks very sensible. But thinking about yields also highlights the key to the sterling outlook.

Please be noted that the GBPUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs (below 7.80% in 1m tenors) along with bearish neutral risk reversal sentiments, accordingly we construct multiple legs of option strategy for regular traders of this currency cross when there is little IV.

Considering the option writer’s opportunity in the short run on cable's lower IVs with bearish neutral delta risk reversals, the option trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data