Technical glimpse:

The pair has been tepid but slightly bearish bias from last couple of months (see monthly charts).

On daily charts, one can see prices can go either way upon make or break of 0.9776 on a closing basis.

The pair could not hold onto major resistances at 1.0093 and 1.0032 levels, this would divulge the bearish sentiments in short term trend perspectives.

OTC outlook:

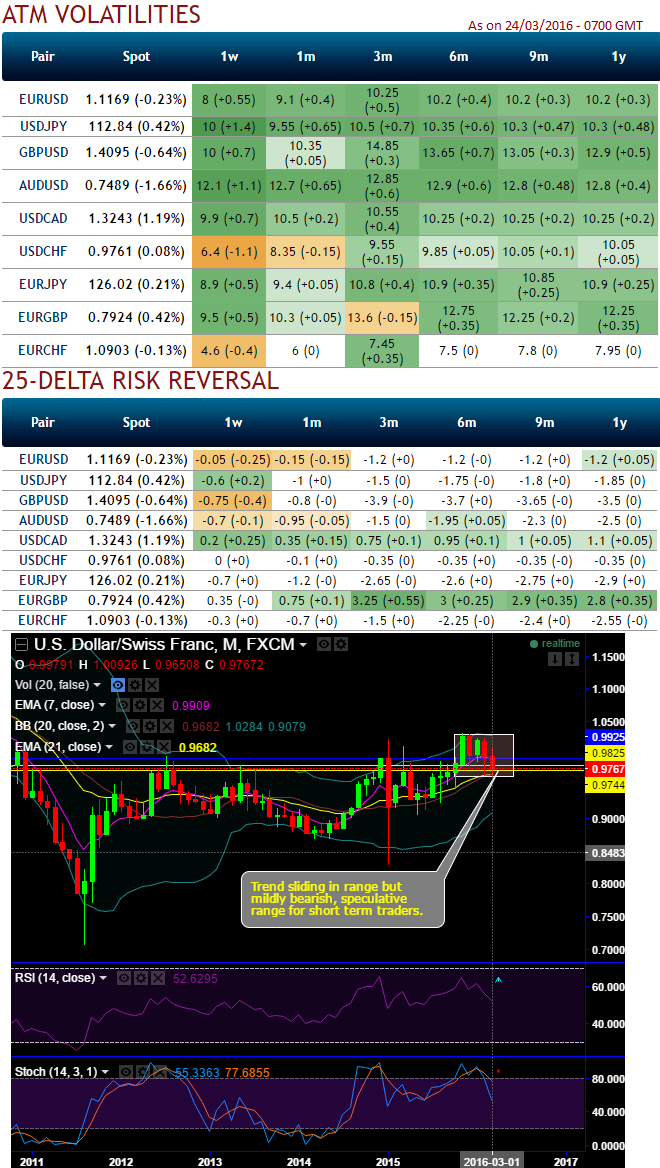

ATM implied volatilities are severely shrinking away, slipped below 7% (to be precise 6.4% for 1W expiries and 8.35% for 1M expiries).

While, risk reversals have also been in sync with IVs and spot FX movements as stated above in technical lines, these numbers also have been bearish neutral for next 1 month or so. 25-delta risk reversals evidences the disparity in volatility, and price, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

Trading tips:

Contemplating on technicals, IVs and risk reversals we USDCHF to continue to go in narrow range, as result we could foresee the range bounded trading opportunity in prevailing range of 1.0096 and 0.9635.

Thus, smart approach USDCHF is that to deal with this lower implied volatility times, we eye on collecting credits or short for premiums, and hope for a contraction in volatility which OTC market has already signalling.

On speculative basis short strangles are the best suitable than any other strategy in prevailing lower IVs condition of USDCHF, hence, we recommend shorting 1W (1%) OTM puts as well as 1W (1%) OTM calls for a net credit.

The strategy not only gives you the advantage of an anticipated volatility crush, but also give us some room to be wrong because we may short premium narrowing strikes while in greed of collecting more credit than when IV is low.