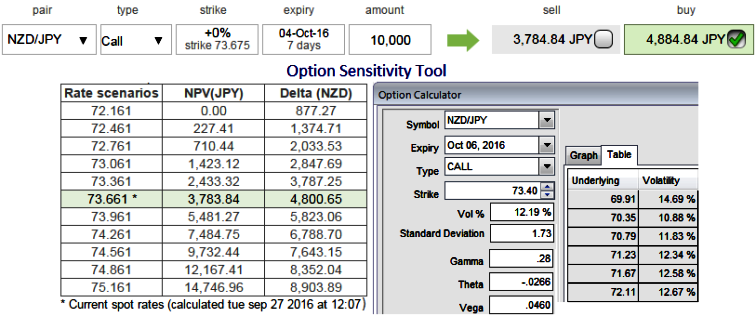

1w ATM calls of this pair are trading 29% more than NPV.

1w ATM implied volatilities are at 12.19%. Standard deviation of this call options 1.6

Hence, we see there exist disparity between IVs and option pricing.

While if you have to think economic event risks, very little AU or NZ releases over the next 28 hours.

China industrial profits finding support from commodity and steel prices, but the pace of growth still soft relative to history.

Moreover, if you have to observe the impact of all these factors in currency prices, technically, On monthly charts, the price declines consistently below EMAs and more slumps likely as spinning top and doji appear with huge volumes. For now, stiff resistance is seen at 73.597 level.

During the month ahead any probe above 73.597 is possible, driven by good quality NZ economic data, and a BOJ’s shift in monetary policy stance, and US treasury yield-chasing inflows. By year end, there’s a case for a correction towards 71.249 levels as the RBNZ eases OCR below 2.00% in November as per the expectations.

Contemplating all these factors lingering around spot NZDJPY rates, we foresee opportunity lies within shorting an OTM call options in any hedging or speculating strategy would determine to be the best selection of option instrument.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics