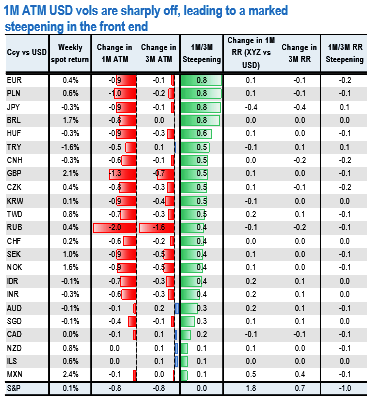

The FX vol market is showing signs of capitulation and front-end vols are softer over the week, leading to vol steepening across the board.

Softer vols in U.S. could provide a momentary soft patch as the Dow Jones broke the symbolic threshold of 20000 on last Wednesday, tripling in nominal value since the lows of 2009, markets seem wrapped up in a spell of euphoria that can only signal radiant optimism on US cyclical upturn and immense credit granted to Trump's emphatic "America First" agenda of protectionism: fiscal easing, infrastructure spending and deregulation. In equity markets, a decent start to the Q4 earnings season is further helping vols flirt with all-time lows.

At 8.5, 1M S&P vol is just a few decimal points above the abnormally low trough of Jun-Jul 2014. While the price action in FX vols doesn’t suggest the same level of complacency, this softness in front end vols is spilling over to 1M USD vols and sending them sharply lower across the board (refer above nutshell).

As March FOMC and the first round of a particularly disputed French presidential elections keep 3M vols firm, this is leading to a marked vol steepening. Such moves are a hallmark of either capitulation or opportunistic profit taking from investors who started the year with a long vol bias -many of them reluctantly as the position suffered from the frailty of garnering a broad consensus.

Long USD IMM positioning at 1yr highs have certainly played a catalyst role in this capitulation, and the upcoming Chinese New Year period of Asian market closures is likely adding to the mood. The market exasperation with front end USD vols is hardly justified by actual gamma performance.

At least if one looks at vol swap returns YTD, and one would be more justified in judging EUR cross vols as expensive to hold. It is not the case that USD gamma is painfully underperforming as of yet, especially when a pair like GBPUSD is able to deliver its largest short squeeze rally since the Brexit vote.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate