The monetary policy divergences driving USDCAD sharply higher the past two weeks were only half surprising. To be sure, the recent sharp rise in US yields driven by hawkish Fed speech came as a surprise to markets.

The motivation for CAD shorts has been expectations of a dovish BoC. The commentary from the BoC has indeed remained dovish in recently with the vice governor was cautioning to look past the temporarily strong data and to reiterated that several structural drags and output gaps remain.

Nonetheless, CAD has outperformed within G10 this week as data has continued to deliver above consensus prints. The notable release this week was the January GDP which printed at double the pace consensus was expecting (at 0.6% m/m).

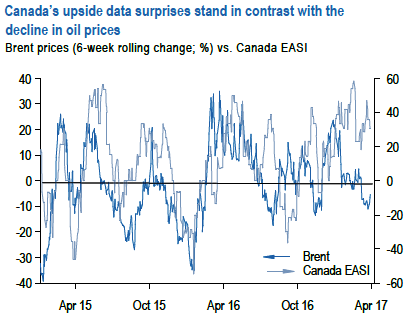

The beats in data have been persistent and broad-based, keeping our economic activity index (EASI) in positive territory since for four consecutive months.

This string of upside surprises should cause the BoC to upgrade their own forecasts in the upcoming April MPR, but the tone will still be dovish given that inflation is still below target and also the recent volatility in oil prices will likely make them cautious.

Outside of monetary policy developments, oil price developments also weigh on near-term CAD. The recent 8% fall in crude oil prices was on the back of a surprisingly strong inventory growth.

Clearly, the price action in oil prices impacts the activity data in Canada materially.

Thus is the March decline in oil prices are sustained, that could turn the tide on positive economic momentum in Canada. Already, the Canadian EASI looks too high relative to Brent prices (refer above chart).

CAD shorts are held vs. USD in order to benefit from diverging monetary policies between the Fed and the BoC and vs. AUD to get exposure to global growth in the portfolio.

Long AUDCAD from 1.0278 since mid-March. Indicative offer 1.0%.

Long USDCAD from 1.3430 April 6, 2017. Indicative offer at 0.81%.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target