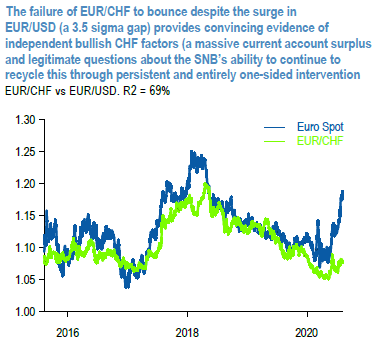

USDCHF has served us well as a proxy EURUSD long. But this is far from being the only reason to hold a CHF long. The chart demonstrates EURCHF that is now nearly seven cents too low given the surge in EURUSD, an undershoot that we take to be compelling evidence of the independently bullish factors that have boosted CHF, and will likely continue to do so.

In essence this is a current account disequilibrium on steroids, insofar as Switzerland found it almost impossible to recycle its 10% of GDP current account surplus even before the onset of global financial repression, hence the reliance on persistent SNB intervention to generate the necessary capital outflows.

There is no definitive limit on the SNB’s ability to continue with this policy to blunt fundamentally justified CHF appreciation in this way; nevertheless, we suspect that an adverse finding by the UST about currency manipulation in its next report would increase pressure on the SNB to scale back its activities and permit rather more CHF appreciation.

While such a finding is not necessarily guaranteed even if Switzerland does now satisfy the three objective criteria to identify manipulation criteria, we continue to regard the forthcoming report as an important asymmetric risk factor for CHF, one that is worth pre-positioning for. Trade tips: Stay short in USDCHF at 0.924. Marked at +1.73%. Courtesy: JPM

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different