The key topic was still Chinese PMIs. Normally the market impact of economic data is short-lived, but obviously, the Chinese PMIs have a much longer and bigger market influence. While the PMI could be impacted by a lot of unknown factors, it still looks like there have emerged some green shoots in China’s economy.

The Caixin manufacturing PMI soared to 50.8 in March 2019 from 49.9 in the previous month, beating market expectations of 50.1. The latest reading pointed to the first increase in manufacturing activity in four months and the strongest since July 2018, as new order growth accelerated to a four-month high, boosted by a rebound in new export orders, and employment increased for the first time since October 2013, with some firms mentioning they were hiring additional workers to support greater production and new business developments.

We reckon that it is better not to take a one-sided opinion. The risk-reward is usually not good if you follow the consensus. The strong Chinese PMIs somehow suggest that the activity data for March would very likely bring in upside surprise, which is almost fully priced in by the market rallies. But what the market might have not been prepared is that the Chinese central bank could hold on the easing tap at some point as the inflation data could also surprise on the upside. Again, it is always important to have a balanced view of China.

OTC FX updates:

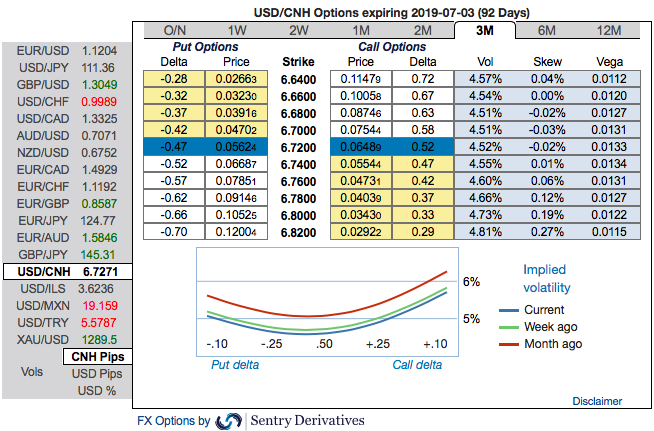

You could easily make out that the positively skewed 3m IVs of USDCNH have been stretched out on either side but little bullish bias (refer above nutshell). This is interpreted as the hedgers' bid for both deep OTM calls and OTM put options.

Trade tips: Buy 3M 40D (6.76 strikes) USD calls/CNH puts vs sell 3M 5.50. Courtesy: Sentrix, Tradingeconomics & Commerzbank

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 81 levels (which is bullish), and hourly CNY spot index has been bearish, creeping at -42 (bearish) while articulating (at 14:01 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different