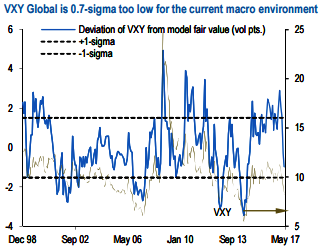

VXY printed fresh Fed-cycle lows this past week and is screening 1 vol cheap vis-à-vis macro correlations. The undershoot is not yet at historical extremes but bears close watching in a seasonally volatile May.

FX vols fell to new lows since the current Fed hiking cycle got underway in December 2014 after another round of relentless compression and especially after French polls, before late-week commodity jitters reversed part of the move.

G10 vols, particularly EUR-bloc ones, are poised for a further decline next week if an as expected Macron win in the second round of the French elections prices out the last remnants of event risk premium from short-dated option prices.

VXY Global regressed on JPM Global PMI, 12-mo rolling std. deviation of Global PMI and an uncertainty indicator constructed as an equally weighted composite of the inter-quartile dispersion of consensus forecasts for three macro variables provided by the Philadelphia Fed’s Survey of Professional Forecasters: 4-qtr ahead real US GDP growth, 4-qtr ahead unemployment rate and 4-qtr ahead headline CPI. Monthly data since 1998.

At 8.0 on VXY Global, we are still some distance off the all-time lows of 1H14, but vols have begun to screen cheap to macro correlates, and valuations deserve close watching from here. In a note published earlier this week, we argued that VXY is screening 1.1 % pts. or 0.7 -sigma too cheap adjusting for the cyclical backdrop and degree of forecast uncertainty among investors (refer above chart), which is on the cheap side, but quite some distance away from the -1.5 to -2- sigma undershoots witnessed during the equity bubble of the early 2000s, ahead of the credit crisis in fall’07, in the lead-up to taper-tantrum in 2013 and before the onset of Fed tightening in mid-2014.

This certainly demands caution around vol selling keeping in mind the degree of dollar cheapness vis-à-vis interest rates and the attendant short USD/long carry positions that have built up through the year, as well as the brutal anti-risk May seasonality, but we are not in flashing red territory yet and there still appears room to selectively run shorts in places where valuations are supportive.

Our market strategy at these tricky valuations is two-pronged.

For core short vol alpha, we favor selectively running shorts in currencies either offering a valuation buffer (TRY), where policy and flow momentum is supportive (BRL), or where explicit currency management can tame realized vol such as CNH. The latter is on our radar as a potential short vol target in the event of smooth passage of the second round of French elections over the weekend.

Second, as a part of the discipline of systematically mining for deep value opportunities created by the ongoing risk premium crunch, we highlight 1Y1Y FVAs in EURJPY as nearing buy levels not seen since before the GFC.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays