Overall trend of this pair fixes it bearish view for a target of 160.207 and may even tumble up to 156.480 in near terms.

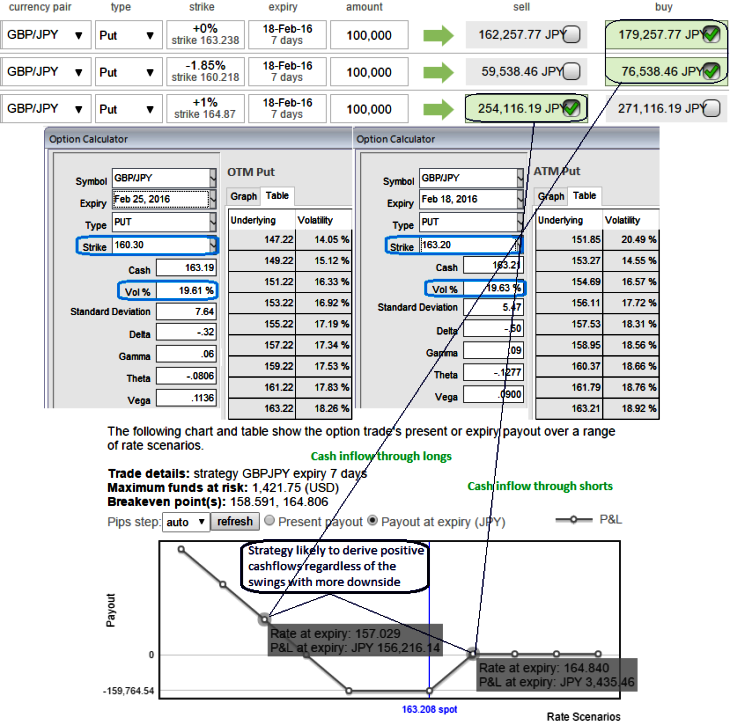

We can ponder arresting this potential downside risks through Put Ratio back Spread in 2:1 proportion and is more effective hedging strategy than any other means when one could sense more bearish momentum.

Subsequently, cause of concern in framing position would be which strikes need to be chosen so as to accurately hedging these downside risks. It's best to plug a back spread into the analyzer before doing the trade to see how the spread reacts to changes in the underlying price, time, and volatility.

Since the pair pops up bearish patterns and have more downside potential, a lot of (1.85% strikes at 160.207) OTM puts are justifiable . And preferred to deploy ATM instruments in the strategy for some considerable reasons,

because ATM instruments may be more expensive than OTM options, but cheaper than ITM options. They carry the highest gamma, vega, and theta which means their premium is the most sensitive to moves in either direction. Moreover, the delta of ATM options are 50%, which means there is an even likelihood of expiring ITM or OTM.

Some intermediate uptrend is seen so far, the bearish turn to resume here onwards, long put instruments to generate positive cash flows as a result.

So, stay firm with longs in at the money -0.51 delta put and out of the money -0.31 delta put that would function effectively. While simultaneously, short 1 lot of ITM put option would generate assured returns on any abrupt rallies, shortly longs on ATM puts are about to function that would take care of potential downswings.

Alternatively, if they wish to short OTM instruments, they sell puts that has delta of less than 0.15. Which means they sell deep out of the money options. The idea behind this trade is that the chance of this option to expire worthless is 85%. (1-0.15 = 0.85 or 85%).

The delta of a back spread or ratio spread is generally dominated by the option with the greater quantity the further it is from expiration. That makes sense, because the more days to expiration, the deltas of options are not as close to 0.0 or 1.00 as they are when there are fewer days to expiration.

Please be noted that the expiries used in the diagram are only for demonstration purpose, use shorter expiries on short side (preferably 4D or 1W maturities).

FxWirePro: Use ATM and OTM puts in GBP/JPY 2:1 PRBS - ATM delta put ensures underlying outrights

Thursday, February 11, 2016 7:06 AM UTC

Editor's Picks

- Market Data

Most Popular