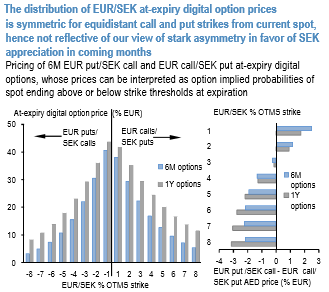

The FX option prices are not priced in the unambiguously positive asymmetry of Swedish Krona spot outcomes. Prices of at-expiry digital (AED) options would be construed as probabilities of spot ending at or beyond strike thresholds at maturity, and are useful for studying the option-implied likelihood of spot outcomes.

One side-effect of the correction in EURUSD has been that PLN and SEK, both of which we like, have fallen further against the dollar than the euro has. That’s not a new pattern and points to heavy positioning, as many people bought ‘euro-alternatives’ rather than the real thing, earlier this year.

The starkly positive asymmetry of SEK spot outcomes is not reflected in option prices. Prices of at-expiry digital (AED) options can be interpreted as probabilities of spot ending at or beyond strike thresholds at maturity, and are useful for studying the option-implied likelihood of spot outcomes.

SEK has long been tilted in favor of significant krona appreciation, albeit with uncertainty around timing given Riksbank's intransigence in adjusting ultra-loose monetary policy even in the face booming economic growth.

The above chart plots the implied distribution of EURSEK over 6-month and 1-year forward windows using EURSEK AED option prices for strikes of varying moneyness.

More than absolute probabilities of up or down moves that can be difficult to assess on a standalone basis, the standout feature of the plot is the lack of any discernible skewness in bullish and bearish outcomes; if anything, the RHS panel shows that strikes beyond ±2% from current market price EUR calls/SEK puts more expensively (i.e. more likely) than comparable % OTMS EUR puts/SEK calls, which militates against the balance of FX risks laid out above and is a textbook instance of disconnect between option market pricing and macro assessment of the spot distribution.

We favor buying zero-cost combinations of long EUR put/SEK call vs. short EUR call/SEK put digitals to position for an eventual normalization of Riksbank policy; for instance, off spot ref. 9.5275, 6M 9.20 EUR put/SEK call vs. 9.80 EUR call/SEK put at-expiry digital risk-reversal has a net premium credit of 2.7% EUR (-5.2 /2.7 two-way indicative. assuming equal EUR notionals/leg). The short strike is above the YTD high, hence reasonable cushion against a backup in spot. Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate