The EURUSD action, is characterised by relatively range-bound spot markets from last two years with only rupture of realised volatility, is not enough to support an imminent rise in volatility.

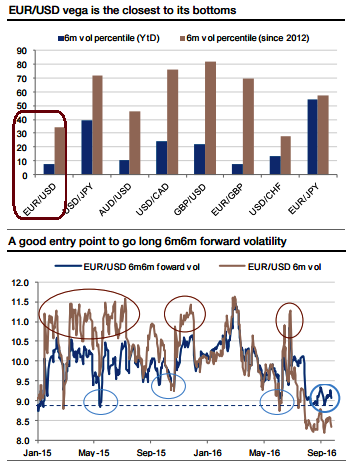

EURUSD is the pair to perceive the least IVs among G7 currency space (6.45% for 1m tenor). An unusually long period of low volatility of volatility is going to be concerning given that volatility is not that low. While vega is also at its lowest level among G10 FX space, we understand that the Vega is the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

However, some fundamental factors (central banks in both Euro zone and the US continents) suggest contemplating long volatility hedges, so we investigate how to take advantage of the current low levels selectively.

FX volatility entered a moderate regime in early 2015 but has been under significant pressure since end-July (see above graph). The limited activity of central banks is clearly to be blamed, as per our H1’ FX outlook call, and in the current context, now that the two main events of the week are over (Fed hike and post-Brexit formalities i.e. article 50), volatility markets are experiencing a further sell-off.

Hence, we recommend going long in EURUSD 6m6m forward volatility agreement @9.25.

Risk profile: If vega underperforms, then the investors trading a FVA receive a straddle at the forward date and are exposed in mark to market to the difference between the traded forward volatility and the 6m implied volatility in six months. Afterwards, the loss is limited to the straddle premium, computed as per the initially traded forward volatility.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand