We have been negative on the EURUSD for quite some time now, and still hold that view. We will be watching if it can clear through the 1.1000 and head towards 1.0925 level convincingly. On the risk front, we remain cognizant that despite the hiccups this week, the market expectation remains for the Sino-US Phase 1 deal to be concluded at some point. Thus, we would not extrapolate the risk-off sentiment too far into the future.

Today’s eurozone GDP data which is unchanged at 0.2% for Q3, we have eurozone PMIs lined-up for the next week.

The unchanged data has shown as to how deep the economic weakness in the single currency area is. What is of much greater interest though is what the future will bring, i.e. how the economy will develop over the coming months and quarters. The leading indicators recently stopped their slide and provided some hope that the worst might already be over.

The ECB has adopted a comprehensive easing package in the face of the economic downturn in September. But thatdoes not mean that the ECB is already done with easing. We expect the ECB to loosen policy further in 2020. We expect another cur of the deposit rate from -0.5% to -0.6%.

OTC Updates:

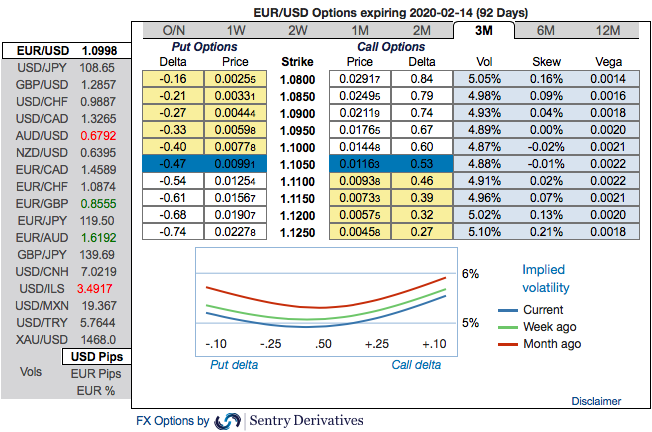

The FX OTC hedging sentiments are suggesting the downside risks are on the cards, the IVs and risk reversals of 1-3m tenors indicate bearish risks are back in action.

The fresh negative risk reversal numbers (RRs) across 1m-3m tenors are observed to indicate unchanged weakness, which is in line with the IV skews and the major downtrend of the underlying EURUSD spot.

To substantiate these indications, 3m skews are stretched on either side (equal interest in both OTM call and OTM puts), 3m positively skewed IVs have still been signalling downside risks and upside risks as well. Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks in the major downtrend.

All these indications coupled with the fundamental factors and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

The interim upswings likely to prolong but the sustenance seems dubious in the long-run. So, it unwise to ignore the bearish stance in the major downtrend which is emphasized even in our technical section as well.

1) At spot reference: 1.1000 levels, initiated long in 2 lots of EURUSD (1%) in the money -0.49 delta put options of 2M tenors, simultaneously, write an (1%) out of the money put option of 2w tenors. Short-legs go worthless as the underlying spot price hasn’t gone anywhere. Any slumps from here onwards are to be arrested by the 2 lots of ATM long-legs.

Those who are sceptic about mild rallies, 2m 1% in the money puts with attractive delta are advised on a hedging ground. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

2) Stay received EUR/USD 3Mx3M OIS/OIS basis

Receive $50k DV01 3Mx3M (swapstart: 12/09/19, swapend: 03/09/20) EURUSD OIS/OIS basis at -59bp. Courtesy: Sentrix, JPM & Commerzbank

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty