The currency pair trades well below the 0.9000 level on board-based US dollar selling. It hit a low of 0.89411 and is currently trading around 0.89435. The intraday bias appears to be bearish as long as the resistance 0.9000 holds.

Markets eye Richmond manufacturing index and CB consumer confidence today for further direction.

Technical Analysis and Resistance Levels

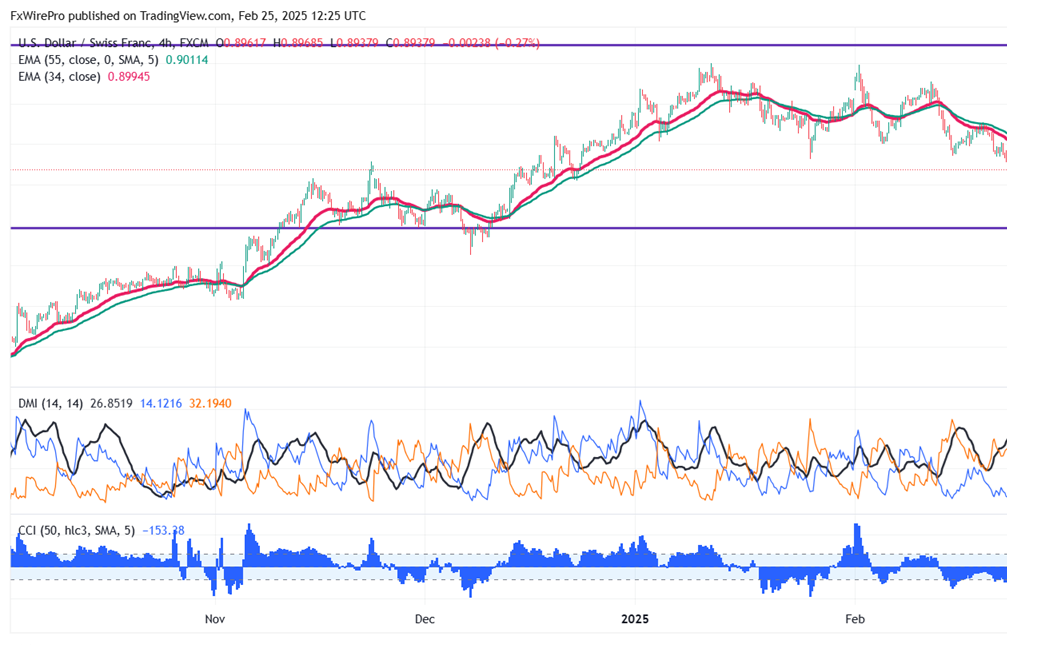

The pair is trading below the 34-EMA and 55-EMA on the 4-hour chart indicating a mixed trend. The immediate resistance is at 0.9000 any break above targets 0.9035/0.9070/0.9100/0.9150/0.9200/0.92250/0.9275/0.9030.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8940, any violation below will drag the pair to 0.8890/0.8800.

Indicators

CCI (50) - Bearish

Directional movement Index - neutral

Trading Strategy Recommendation

It is good to sell on rallies around 0.9000 with a stop-loss at 0.9040 for a TP of 0.8940/0.8900.

FxWirePro: EUR/ NZD neutral in the near-term, scope for downward resumption

FxWirePro: EUR/ NZD neutral in the near-term, scope for downward resumption  EUR/USD Powers Higher on Dismal US Retail Sales Miss: Bullish Breakout Brewing Toward 1.2000?

EUR/USD Powers Higher on Dismal US Retail Sales Miss: Bullish Breakout Brewing Toward 1.2000?  FxWirePro: NZD/USD firms, setting up for next leg higher

FxWirePro: NZD/USD firms, setting up for next leg higher  NZD/JPY Slips as Yen Strength Returns: Bears Eye Deeper Drop Toward 90.00

NZD/JPY Slips as Yen Strength Returns: Bears Eye Deeper Drop Toward 90.00  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  EURGBP Breaks Above 0.8700 on Euro Surge: Bullish Momentum Builds Toward 0.8800+?

EURGBP Breaks Above 0.8700 on Euro Surge: Bullish Momentum Builds Toward 0.8800+?  FxWirePro: USD/ CNY outlook weaker on renewed downside pressure

FxWirePro: USD/ CNY outlook weaker on renewed downside pressure  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  GBP/JPY Slips Below 210 as Yen Surge Turns Rallies into Selling Opportunities

GBP/JPY Slips Below 210 as Yen Surge Turns Rallies into Selling Opportunities  FxWirePro: GBP/NZD downside pressure builds, key support level in focus

FxWirePro: GBP/NZD downside pressure builds, key support level in focus  FxWirePro: USD/JPY slides below 154 level, scope for further downside

FxWirePro: USD/JPY slides below 154 level, scope for further downside