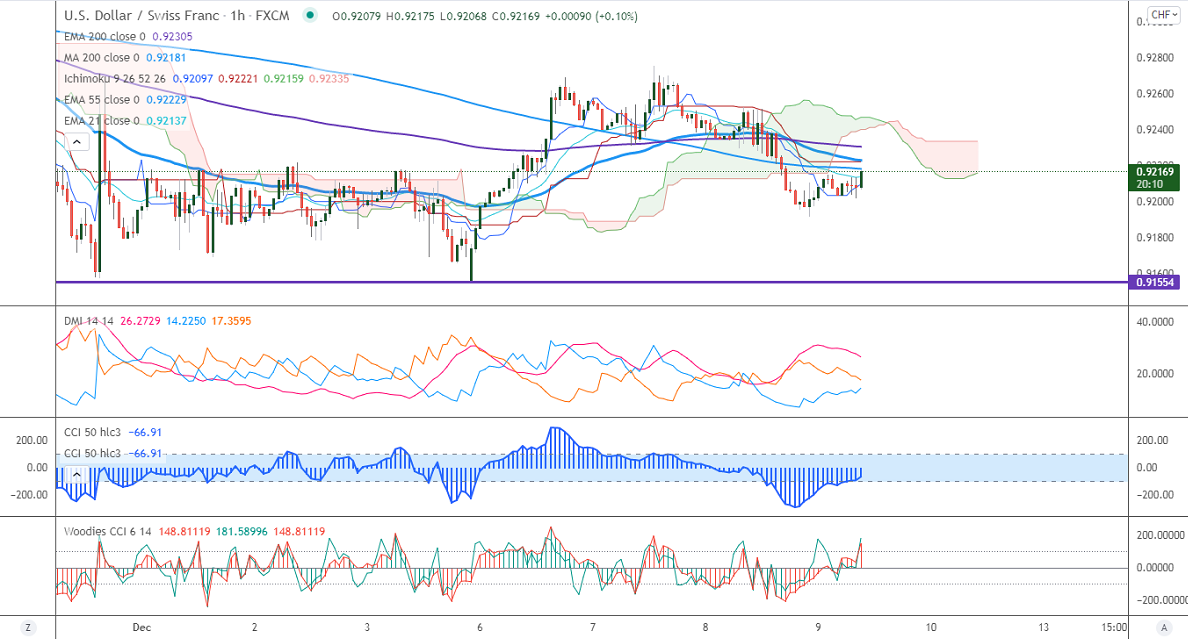

Intraday trend – Neutral

Major intraday resistance – 0.92755

The pair has once again declined after a minor pullback above the 0.92650 level. It has formed a double top around 0.92700, any breach above 0.927500 confirms intraday bullishness. The weakness in the US dollar is putting pressure on this pair at higher levels. Intraday bias in USDCHF remains bearish as long as resistance 0.92750 holds. The slight demand for safe-haven assets like Swiss franc due to new corona variant Omicron. A jump of more than 15% in the US 10-year yield is preventing the pair from further sell-off. It hits a low of 0.091915 and is currently trading around 0.92105.

The near-term resistance is around 0.9240, any breach above targets 0.92750/0.9330/0.9380. Overall bullish continuation only above 0.9380.

The minor support to be watched is 0.9180; the violation below will drag the pair down till 0.9150/0.9090.

Indicators (4 Hour chart)

Directional movement index – Neutral

CCI (50) - Neutral

It is good to sell on rallies around 0.9238-40 with SL around 0.9280 for a TP of 0.9150.