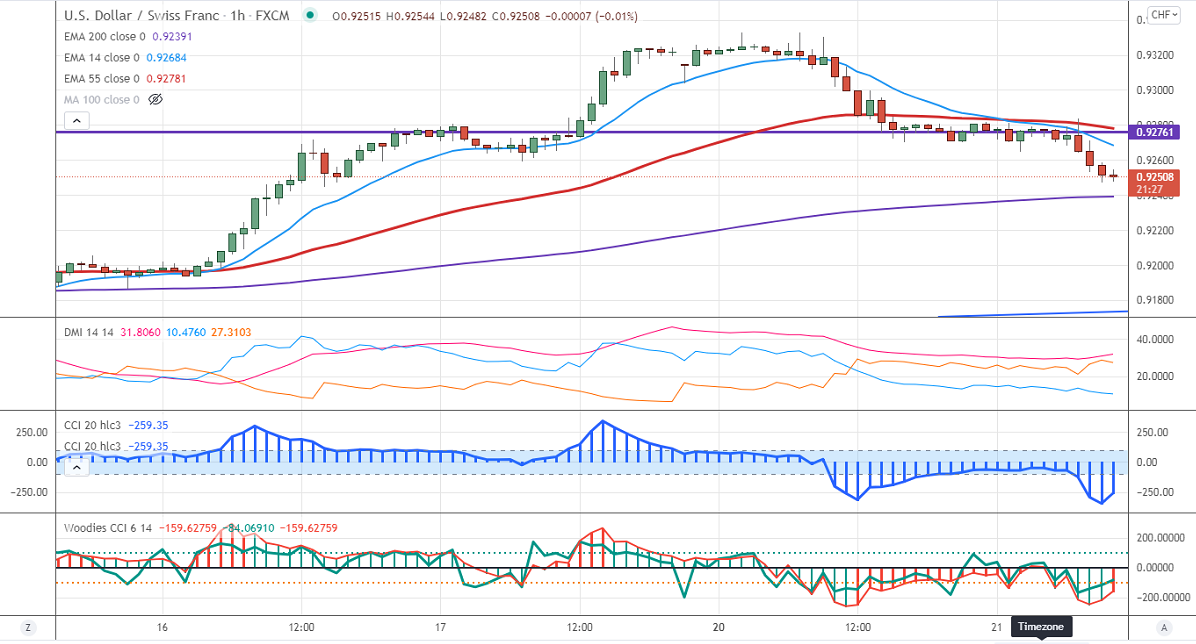

Major Intraday resistance -0.92850

Intraday support- 0.92380

The pair has halted its three weeks of the bullish trend and shown a minor decline on board-based Swiss franc buying. Markets eye the US fed monetary policy for further direction. The US dollar index lost more than 30 pips from the minor top 93.45. At the time of writing, USDCHF is hovering around 0.92526 down -0.21%.

Woodies and CCI analysis-

Both CCI (50) and Woodies CCI is below the zero lines (bullish trend).

In Woodies CCI six consecutive bars should close below zero for bearishness (here only 5 bars closed below zero lines). So intraday bearishness is not confirmed.

Trend-Neutral

USDCHF is trading below 0.92750 and facing strong support at 0.92380. Any breach below confirms the intraday bearishness. A dip to 0.9180 is possible. On the higher side, immediate resistance is around 0.9300. Any convincing jump above targets 0.93350/0.93650.

Indicator (1-hour chart)

Directional movement index –Bearish

It is good to sell on rallies around 0.9255-58 with SL around 0.9300 for a TP of 0.9180.