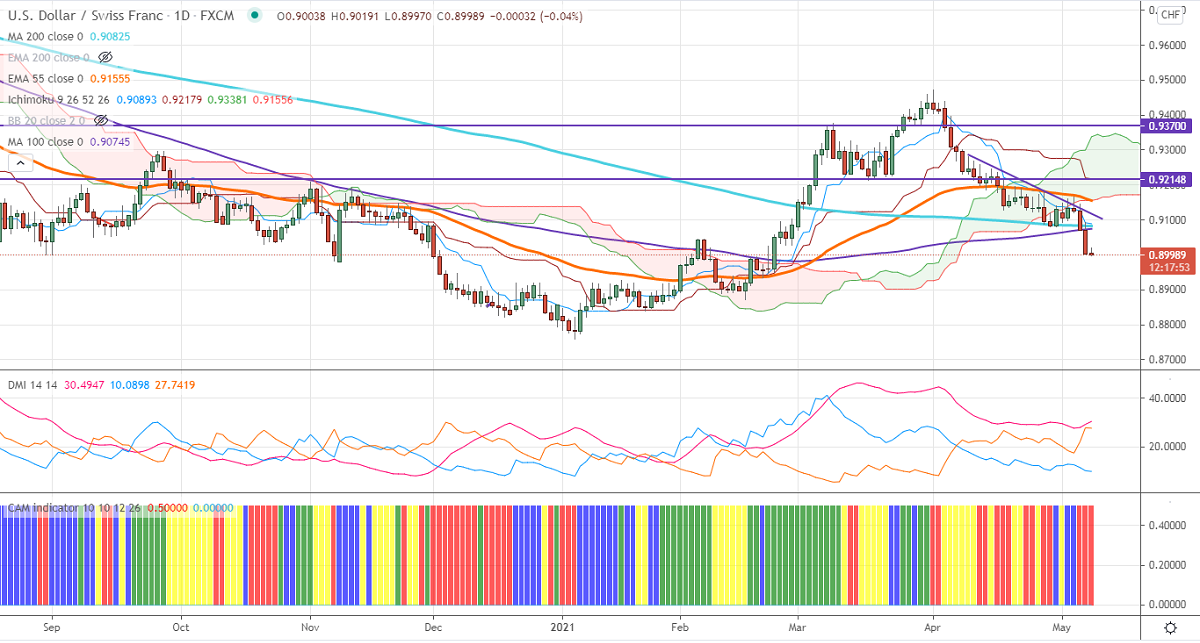

Ichimoku analysis (Daily chart)

Tenken-Sen- 0.90918

Kijun-Sen- 0.92205

USDCHF is trading extremely weak for the past fifth week and lost more than 450 pips on broad-based US dollar selling. The US dollar index continues to trade lower for the fifth consecutive days and lost more than 300 pips on upbeat market sentiment and dovish comments by Fed chairman Powell. The US 10-year bond yield surged more than 8% from minor bottom 1.48%. The US Non-Farm payroll raised by 266000 in Apr much below estimates of 990K and the unemployment rate increased to 6.1% from 6%. Average hourly earnings m/m surged to 0.7% vs estimate 0.0%. The intraday trend of USDCHF is still lower as long as resistance 0.9030 intact. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bearish

The pair is holding well below 200-day MA, this confirms further bearishness. A decline till 0.8870/0.8830/0.8750. On the higher side, any break above 0.9030 will pave the way for the pair to reach 0.9075/0.9120.

Ichimoku Analysis- The pair is trading slightly below hourly Kijun-Sen and cloud. Major bearishness only if it breaks 0.9080.

Indicator (Daily chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 0.90290 with SL around 0.9075 for a TP of 0.0.8850.