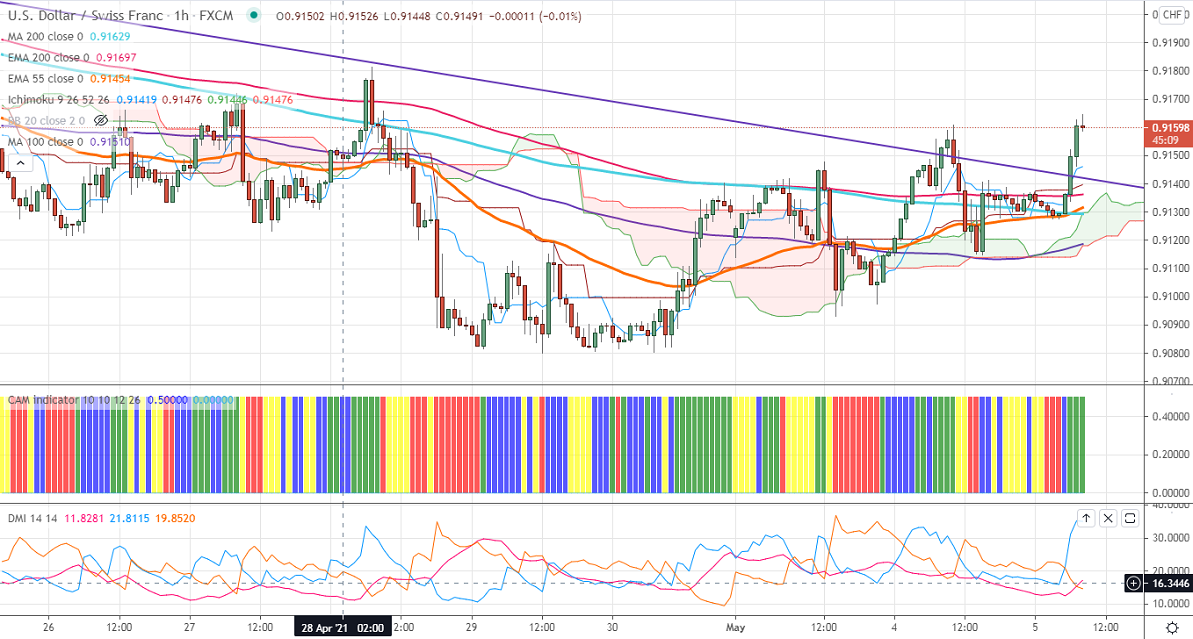

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 0.91453

Kijun-Sen- 0.91389

USDCHF is trading in a narrow range between 0.90807 and 0.91608 for the past four days. The broad-based US dollar buying is supporting the pair at lower levels. The trend is still lower as long as resistance 0.9180 intact. The factory orders rose 1.1% in May compared to -0.5% the previous month. Markets eye ADP employment and US ISM services PMI for further direction.

The US dollar index jumped sharply after hitting a minor bottom around 90.86. Any violation above 91.50 confirms minor bullishness. The long-term trend is still on the downside as long as resistance 0.94725 holds.

Intraday day outlook:

Trend- Bullish

On the higher side, any close above 0.91500 will pave the way for the pair to reach 0.9185/0.9220. The pair is facing significant support at 0.9120; any breach below will take the pair to 0.9080/0.9050/0.9020. Minor trend continuation only if it closes above 0.92050.

Ichimoku Analysis- The pair is trading slightly below 4- hour Kijun-Sen and cloud. Major bearishness only if it breaks 0.9080.

Indicator (Daily chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to buy on dips around 0.9140 with SL around 0.9090 for TP of 0.9265.